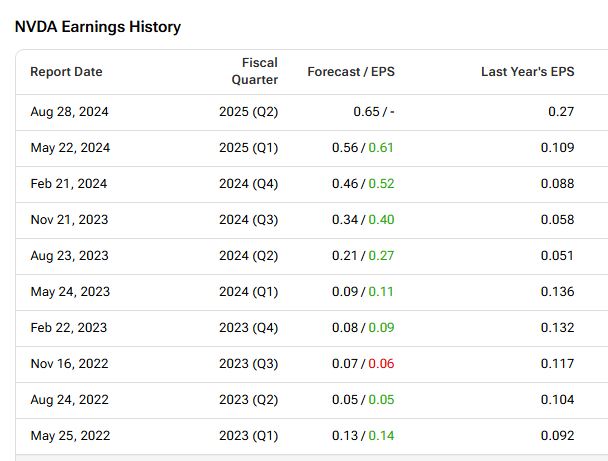

AI giant Nvidia (NVDA) will release its Fiscal Q2 2025 financials on August 28. Analysts are predicting strong top- and bottom-line growth in Q2. They expect the company to report earnings of $0.65 per share and revenues of $28.72 billion, reflecting a robust 140% and 113% year-over-year increase, respectively, according to TipRanks’ data.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

In terms of share price growth, NVDA stock has skyrocketed 487% over the last three years and 161% year-to-date, highlighting the company’s explosive growth. Given this impressive rally, it’s no surprise that NVDA boasts a strong earnings surprise history, surpassing estimates in eight of the past nine quarters.

Analysts’ Opinions Ahead of Q2 Results

According to TipRanks’ Bulls Say, Bears Say tool pictured below, bullish analysts are confident in Nvidia’s market dominance, highlighting strong demand from U.S.-based cloud service providers, who have placed significant orders ahead of a 2025 rollout. They also emphasize Nvidia’s leadership in AI and accelerator technology, with the upcoming Blackwell architecture expected to deliver up to 4x better training and 30x better inference performance than the current generation.

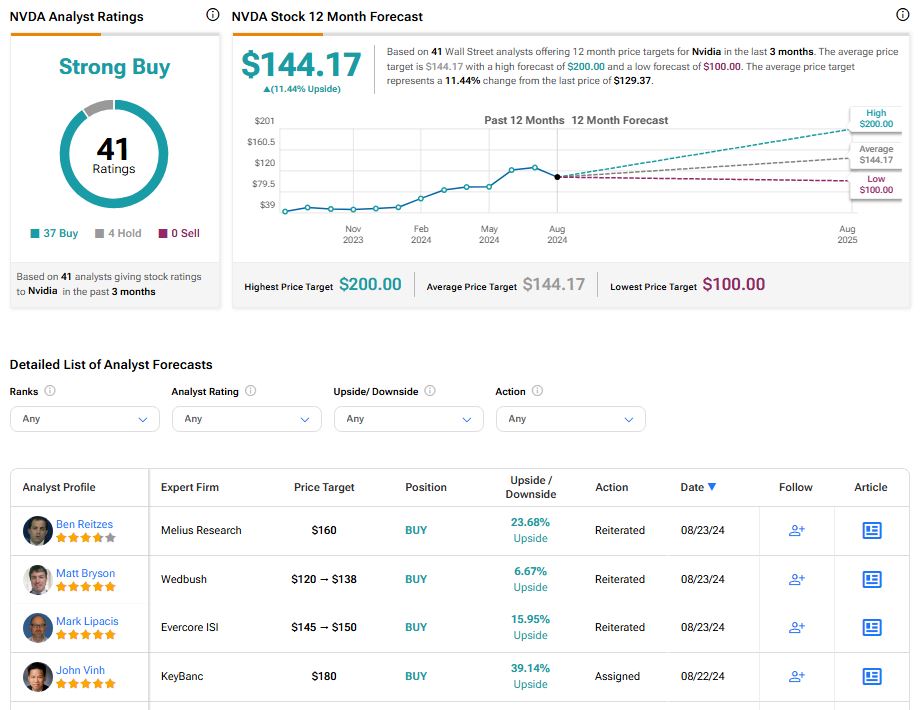

This optimism is further supported by analysts’ actions ahead of Nvidia’s Q2 results. Over the past week, nine analysts have maintained their Buy ratings on the stock, and three top-rated analysts have raised their price targets, underscoring their confidence in Nvidia’s growth potential.

However, Deutsche Bank’s Ross Seymore, who ranks among the top 1% of Wall Street experts, maintained a Hold rating on NVDA. While Seymore isn’t worried about the company’s fundamentals and remains optimistic about its Q2 performance and growth prospects, he prefers to stay on the sidelines due to the stock’s valuation. He believes the shares are fully valued at their current levels.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 11.01% move in either direction.

Is Nvidia a Buy, Sell, or Hold?

Despite the stock’s solid rally over the past few years, Wall Street’s sentiment on NVIDIA appears exceedingly bullish, reflecting a combination of 37 Buy and four Hold recommendations over the past three months. At an average price target of $144.17, the average NVDA stock price target implies 11.44% upside potential.