Nvidia (NVDA) stock is trading near an all-time high as the rally in microchip and semiconductor companies appears to be reignited.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

NVDA stock has gained 10% in the last five trading sessions and is currently changing hands at $133 per share. The stock is close to its record closing high of $135, which it reached in June of this year shortly after the shares split on a 10-for-1 basis.

Throughout the summer, Nvidia’s stock declined as investor enthusiasm for chipmakers and the artificial intelligence (AI) trade cooled off. But now, investor sentiment has turned bullish once again. Other chip stocks are also rallying to start October, with Broadcom (AVGO) stock up 8% and Advanced Micro Devices (AMD) stock up 7% in the past five trading sessions.

Lifted by Taiwan Semiconductor Sales

Giving NVDA stock a boost and pushing it towards a record high has been the latest sales figures from Taiwan Semiconductor Manufacturing Co. (TSM), the foundry that manufactures about three-quarters (75%) of the world’s microchips, including Nvidia’s processors.

Taiwan Semiconductor reported a 40% year-over-year rise in its September sales as demand for AI microchips skyrockets. Taiwan Semi’s sales are viewed as a bellwether for the entire microchip industry and are seen as a good sign for Nvidia’s sales and financial results. Management at Taiwan Semiconductor have announced plans to double their chipmaking capacity to meet global demand.

Is NVDA Stock a Buy?

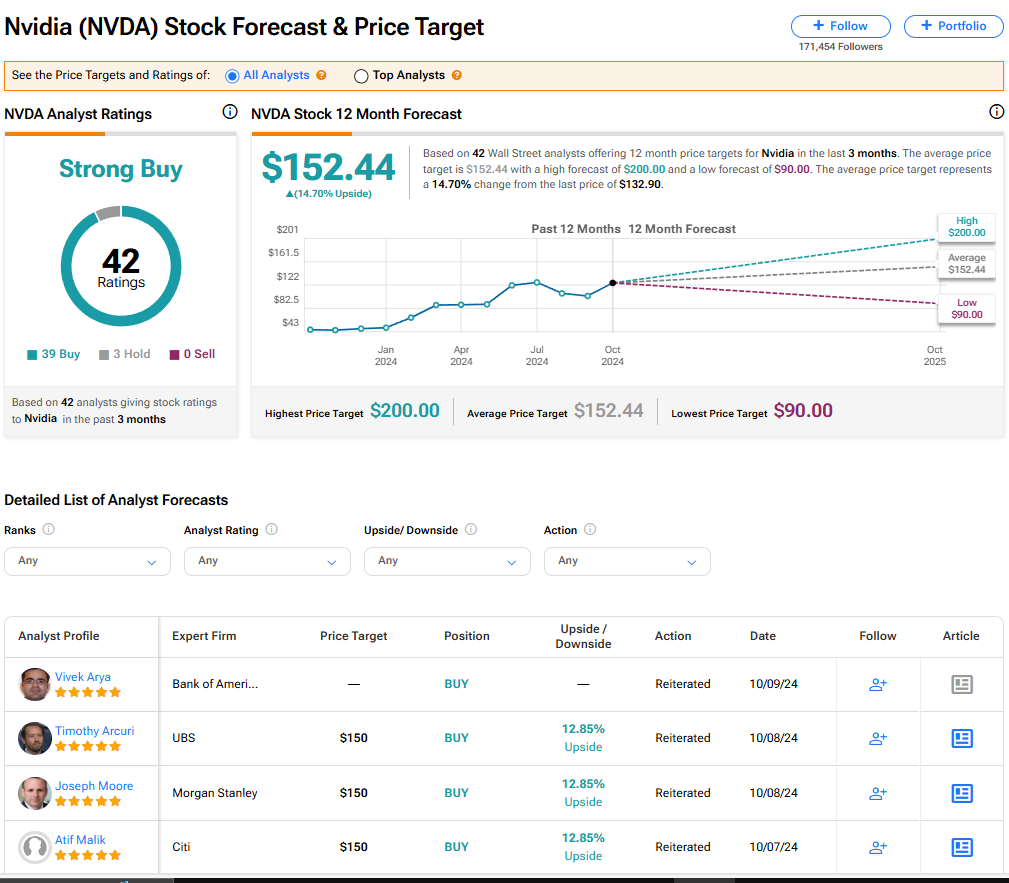

Nvidia stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 39 Buy and three Hold recommendations made in the last three months. There are no Sell ratings on the stock currently. The average NVDA price target of $152.44 implies 14.70% upside potential.