Nvidia’s (NVDA) CEO, Jensen Huang, has dropped a truth bomb: in the battle against AI-generated misinformation, only artificial intelligence will be quick enough to outsmart itself. At an event on September 27 at the Bipartisan Policy Center, Huang said, “It’s going to take AI to catch the darker side of AI,” stressing that AI is poised to produce fake data and false information at alarming speeds. Huang isn’t mincing words here; he’s pointing out that just like cybersecurity threats, this is a race to stay ahead. The risks are real, and we’re not talking about hypothetical scenarios—this is already happening.

AI Speeds Threaten Election Integrity

One of the most immediate concerns is the upcoming U.S. elections. According to Pew Research Center, nearly 60% of Americans are seriously worried that AI could be used to create fake information about presidential candidates. That’s a staggering number, and it’s not without reason. Just days before Huang’s remarks, ABC News reported that Russia and Iran are already using AI to alter videos of Vice President Kamala Harris’ speeches, a chilling reminder of what’s at stake.

AI’s ability to produce misleading information at lightning speed poses a serious threat to election integrity. As Huang noted, the U.S. government needs to “become a practitioner of AI” rather than merely governing it. He urged federal departments like Energy and Defense to embrace AI to defend against emerging threats. Essentially, if we want to beat AI-driven misinformation, we need AI-powered defense strategies in place.

Nvidia’s Stock Benefits from Its AI Expertise

Nvidia’s dominance in the AI space is not just talk. The company is known for its cutting-edge GPUs, which are essential for running complex AI models and data centers. This technological edge has made Nvidia’s stock a standout in the semiconductor market, with its shares climbing over 200% this year alone. Investors have flocked to Nvidia as AI demand has surged.

This insider knowledge positions Nvidia as a leader in the AI race, giving weight to Huang’s warnings. When he speaks about AI risks and solutions, it’s coming from a place of authority. With more companies and governments likely turning to Nvidia for advanced AI solutions, the company’s insights are important not just for tech enthusiasts, but also for investors looking to capitalize on the growing AI sector.

AI Will Teach AI—and Consume Energy

Huang also touched on how AI could learn from itself, creating what he called a “cascade of AI models.” This isn’t just a neat science fiction idea—AI models will likely teach other AI models in the near future. However, this requires a massive amount of energy. Huang predicted that AI data centers will eventually need 10 to 20 times more energy than current ones, with some solutions involving placing these centers where there’s excess energy, such as remote locations where energy might otherwise go to waste.

As noted by Cointelegraph, this idea of “teaching AI with AI” sounds efficient, but it’s also going to be an energy guzzler. And as Huang put it, “AI doesn’t necessarily care where it learns,” opening up the possibility of building data centers near surplus energy sources. The concept of transporting the data center to where the power is adds an interesting layer to the challenge of managing AI’s future growth.

Is Nvidia a Good Stock to Buy Now?

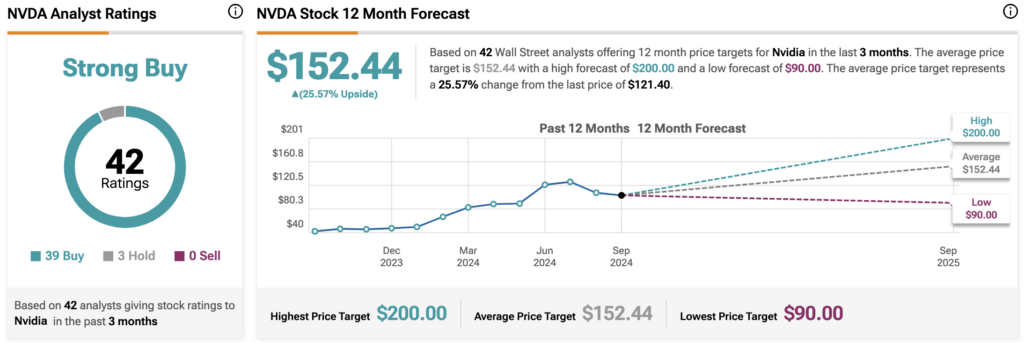

Analysts remain bullish about NVDA stock, with a Strong Buy consensus rating based on 39 Buys and three Holds. The average NVDA price target of $152.44 implies an upside potential of 25.6% from current levels.