Following the release of nVent Electric’s (NYSE:NVT) mixed third-quarter results on Friday, Goldman Sachs analyst Joe Ritchie reaffirmed a Buy rating on the stock. The analyst believes that NVT’s fourth-quarter earnings guidance of $0.73 to $0.75 is conservative, given favorable price-to-cost dynamics and increasing productivity.

Ritchie’s Buy rating on nVent stock is based on the company’s favorable position in the electrical market and a strong track record of execution. Beyond 2023, the analyst expects NVT to increase investment in infrastructure, benefit from strong orders for Data Solutions, and witness solid growth in the Thermal Management unit.

nVent’s Q3 Snapshot

The electric solution provider’s Q3 adjusted earnings of $0.84 per share surpassed analysts’ estimates of about $0.73 and increased 27% from the prior-year quarter. Meanwhile, the company’s revenues rose by 15% year-over-year to $858.8 million but remained below analysts’ expectations of $882 million.

Looking ahead, NVT raised its 2023 sales growth expectations to 12% to 13% versus prior guidance of 13% to 15%. Also, the company anticipates adjusted EPS of $3.01 to $3.03, compared with the $2.85 to $2.91 previous range.

What is the Price Target for NVT?

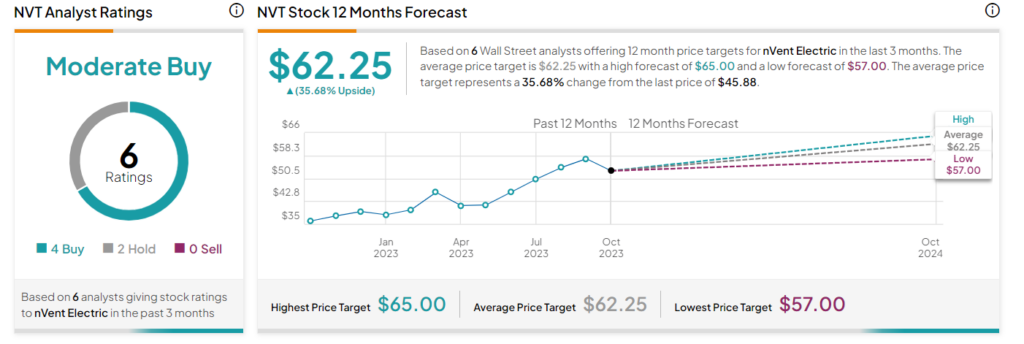

After the Q3 earnings announcement on Friday, three analysts rated the stock a Buy, while KeyBanc analyst Jeffrey Hammond maintained a Hold rating on NVT stock.

Overall, nVent stock has received four Buy and two Hold recommendations for a Moderate Buy consensus rating. The average NVT stock price target of $62.25 implies 35.7% upside potential from current levels.