Nvidia (NASDAQ:NVDA) is the top beneficiary of artificial intelligence (AI)-driven demand, which has significantly boosted its share price. Despite the notable increase in NVDA’s share price, Wedbush analyst Daniel Ives expresses optimism over its prospects. In addition, Ives holds a bullish outlook on Microsoft (NASDAQ:MSFT), Meta Platforms (NASDAQ:META), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Palantir Technologies (NYSE:PLTR) stocks ahead of their upcoming results.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Ives believes that MSFT, META, GOOGL, PLTR, and AMZN are the top companies that should benefit from the monetization of AI-driven demand in Q1. Notably, Microsoft, Amazon, Meta, and Alphabet stocks are also among Jefferies analyst Brent Thill’s top AI picks.

With this background, let’s look at what the analysts’ consensus ratings reveal about these AI stocks.

What are the Best AI Stocks?

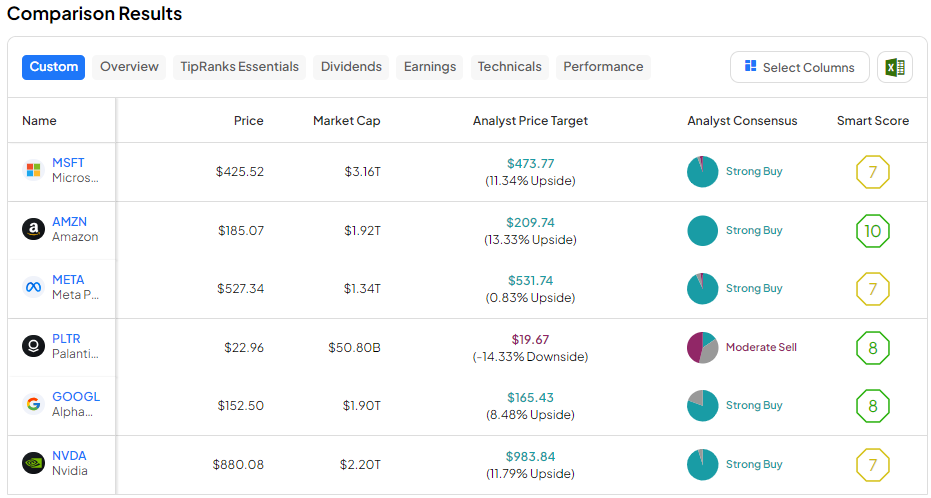

TipRanks’ Stock Comparison tool shows that Wall Street analysts are optimistic about NVDA, MSFT, GOOGL, META, and AMZN stocks. All of these stocks sport a Strong Buy consensus rating. However, analysts are bearish about PLTR’s prospects.

Palantir’s success in leveraging AI technology through its AI platform has significantly boosted its share price. Its stock is up about 34% year-to-date and nearly 174% over the past year. The launch of the AI platform has facilitated the company in securing high-value deals, fuelling optimism among investors. However, analysts’ bearish stance suggests that the positives are already factored into the stock’s price.

PLTR stock has a Moderate Sell consensus rating. Further, the average PLTR stock price target of $19.67 implies 14.33% downside potential from current levels.

Meanwhile, AMZN is the only stock sporting a Strong Buy consensus rating and a “Perfect 10” Smart Score. It’s worth noting that the Top Smart Score Stocks tend to have greater potential for outperforming market averages.