While there are those out there who are still trying to make the leap from apartment to full house, others might be thinking about owning Netflix (NFLX) House. The streaming giant’s major live attraction at the King of Prussia Mall–rather, the building housing it–will be going up for sale.

The former Lord & Taylor store, a two-level, 120,000-square-foot operation that will be a Netflix House in 2025, will still be a Netflix House in 2025. But the building’s owner may be a whole different matter. Reports from Philadelphia Business Journal reveal that the owner of the space is HBC, a retail company that owns and manages the space under its HBC Properties arm.

While there is no listed price for the building, an appraisal from 2011 puts it at $7.37 million. Though certainly, the price of everything has gone up in the interim, recent real estate losses might put the price at least within shouting distance of that earlier appraisal. The current listing calls for a 10-year net lease to start December 31, 2024, and includes “…a corporate guaranty from Netflix…as well as 2.5% annual rent escalations.”

Unhappy Viewers?

While this could be a great way to connect with the viewing public and make some money on the side through food and merchandise sales, one other point may be causing more contention than Netflix might like. That point? “Split-in-half” shows, as a Forbes report called them.

Basically, the report takes issue with the release schedules for Netflix series, including Outer Banks season four. The series will see its first half of five episodes released on October 10, and its second part released just short of a month later, on November 7. Fans noted that the previous three seasons did not receive such treatment and want a return to the “traditional Netflix binge.”

Over time, disgruntled viewers noted, it has become more like the “traditional Netflix butchering.” This appears to be deliberate; a first season gets the binge treatment and, should it be popular, gets broken up into multiple debuts.

Is Netflix a Buy or Sell?

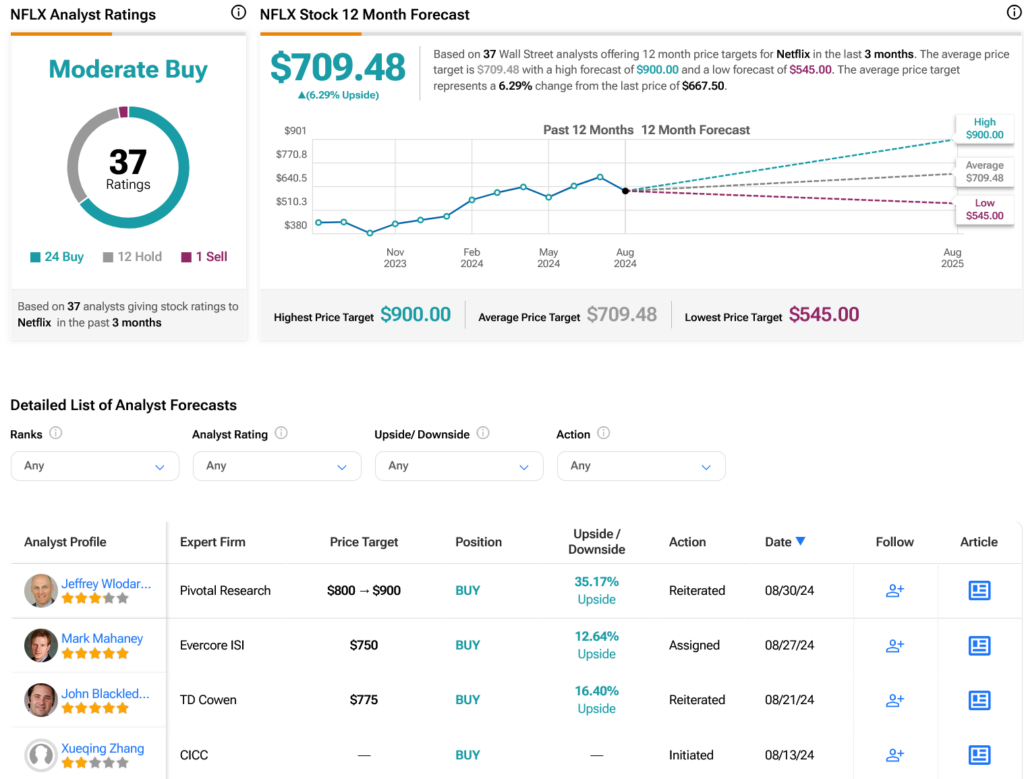

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 24 Buys, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 50.25% rally in its share price over the past year, the average NFLX price target of $709.48 per share implies 6.29% upside potential.