Financial services major Citigroup Inc. (NYSE: C) recently revealed that it will be selling off its consumer banking business in Bahrain to Ahli United Bank B.S.C.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, shares of the company remained almost static to close at $52.76 in Monday’s extended trade.

The deal, which includes Citi’s retail banking, credit card and unsecured lending businesses, is likely to close in the second half of 2022. Post the sale, Ahli United Bank will offer employment to Citi’s consumer employees.

Citi has been exiting its consumer businesses in some markets of the Asia Pacific and Europe, the Middle East and Africa. Last week, it divested its consumer business in India to Axis Bank Limited in an all-cash deal worth $1.6 billion.

Management Commentary

The CEO of Legacy Franchises at Citi, Titi Cole, said, “This is a positive outcome for our colleagues and our clients in Bahrain, and our top priority is to manage and support them through a seamless transition to AUB. We are proceeding with the same consideration for our remaining consumer exit markets.”

Stock Rating

Recently, Wells Fargo analyst Mike Mayo reiterated a Buy rating on the stock with a price target of $70, which implies upside potential of 32.6% from current levels.

Consensus among analysts is a Moderate Buy based on nine Buys, seven Holds and one Sell. Citi’s average price target of $73.44 implies upside potential of 39.1% from current levels. Shares have declined 27.4% over the past year.

Negative Sentiments

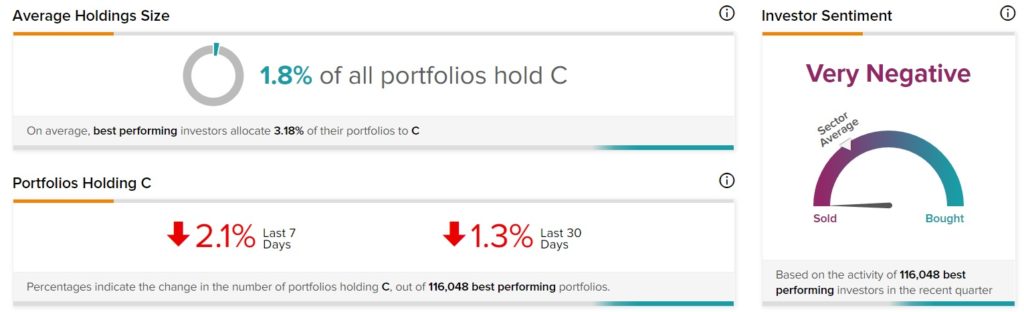

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Citi, as 1.3% of portfolios tracked by TipRanks decreased their exposure to the stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ryanair Issues Upbeat Fiscal 2022 Guidance

Toyota Releases U.S. Vehicle Sales Figures

Robotiques Broadens its Portfolio with Vuzix Smart Glasses