The tanker sector is entering a boom cycle, and Nordic American Tankers (NYSE:NAT) is one well-positioned company that is taking advantage of it. While some may assume that the widely reported disruption near the Red Sea and the Panama Canal would negatively impact shipping and tanker companies, the reality is very far from this. Nordic American Tankers saw its earnings surge in 2023, and this should continue into 2024 and beyond, supporting the company’s mega 12.2% dividend yield.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As a result, I am bullish on NAT stock.

The Boom Cycle

The tanker sector is in the middle of a boom cycle. Chartering rates for vessels are at all-time highs, and the reason for this is limited supply and resurgent demand. The pandemic is naturally a part of the equation. During 2020 and 2021, disruption to hydrocarbon demand and transportation requirements had widespread implications for the sector.

When demand for tanker storage fell, operators began delaying orders for new vessels, given the uncertain future. The issue is that the giant tanker vessels take some time to be produced. It typically takes between two and four years from commissioning the new ship to it entering service. The result is an inelastic supply and an aging tanker fleet.

Several factors have exacerbated the tightness of supply. As alluded to earlier, we’ve been hearing a lot about disruptions to global shipping. There are attacks by Houthis in the Bab el Mandeb strait, a drought affecting the Panama Canal, and Western sanctions on Russia. The former means that vessels are often being rerouted as they transit between Europe and Asia, adding as much as 70% on a journey from the Gulf to the Mediterranean.

With just 24 vessels transiting the Panama Canal per day in January — down from around 50 — tankers are having to wait longer or transit further before getting to their destinations. And sanctions on Russia means that hydrocarbon products originally meant for Europe are now being redirected to Asia. Collectively, these factors are taking supply out of the market as vessels are taking longer to complete each transit.

Earnings Improve

In the last quarter of 2023, Nordic American reported that its net profit came in at $17.5 million, translating to EPS of $0.08. As the company highlighted, earnings for the quarter surpassed the net profit recorded for the entirety of 2022, which stood at $15.1 million. This was also more than double the net profit from Q3 2023, which was $7.5 million.

As such, we can potentially see the material impact of the Panama drought and the Israel-Hamas war — and subsequent attacks by Houthis — on earnings for the quarter. In Q4 2023, the average time charter equivalent (TCE) for spot vessels reached $41,580 per day per ship — far above operating costs at $9,000.

Moving forward, management said that they expect the market to remain robust. The company highlighted that the scarcity of its ship type is driving these strong results (Nordic American operates a fleet of 20 Suezmax vessels with an average age of 12.6 years).

In fact, since late 2023, probably due to the attacks on vessels transmitting the Bab el Mandeb, the price for chartering Suezmax tankers — the largest tankers to fit through the Suez Canal — has surged relative to VLCC and Aframax vessels. The spot rate of Suezmax tankers is currently $44,000, ahead of Aframax at $42,000 and VLCC at $39,000. Q1/Q2 2024 results could also be aided by the addition of new vessels.

While Nordic American does appear to be in a great position to be able to take advantage of the prevailing trends, it’s also worth noting that it doesn’t have the youngest fleet. Yes, there are older fleets still, but some of Nordic’s vessels — those older than 15 years — are likely too old to operate on prime contracts. These are the contracts with the big hydrocarbon and trading companies that tend to command the best spot rates.

However, on the plus side, Nordic American looks phenomenally cheap at just 6.7x forward earnings and operating with low debt. The Bermuda-headquartered company claims to have one of the lowest debt levels among publicly listed tanker companies. Net debt stands at $232 million, or equal to $11.6 million per vessel.

Is Nordic American Tankers Stock a Buy, According to Analysts?

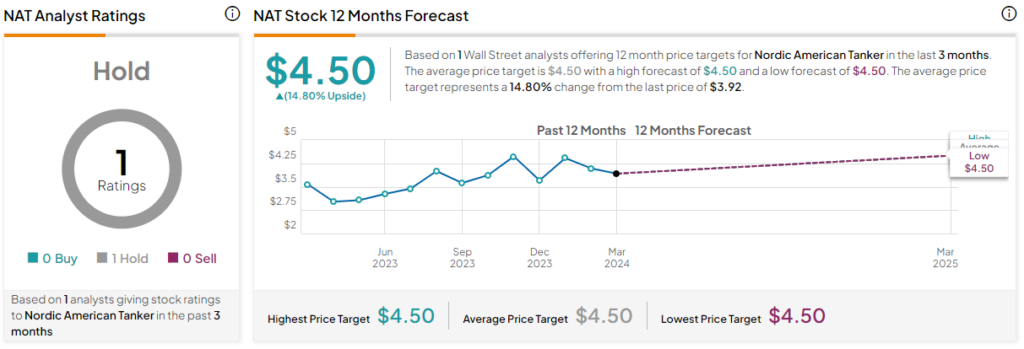

Nordic American Tanker stock comes in as a Hold based on just one analyst rating in the past three months. Nordic American Tanker stock’s price target of $4.50 implies 14.8% upside potential. Looking further back, there were four additional analysts’ ratings during the previous 12 months. All four assigned Buy ratings.

The Bottom Line

Nordic American Tankers has one of the strongest dividend yields I’ve come across. While giant dividend yields can often be a warning sign, the business is performing very well on the back of surging chartering rates engendered by a dearth of supply, notably of Suezmax tankers. Moving forward, this firm looks set to benefit from a boom cycle in the tanker sector.