Following months of negotiations, Nissan Motor (NSANY) and Renault Group (RNLSY) agreed to retain a 15% cross-shareholding with 15% voting rights in each other’s companies.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Renault had about a 43.4% stake in Nissan, which the latter wanted Renault to reduce to 15%.

Per the agreement, Renault Group would now transfer 28.4% of Nissan shares into a French trust. Further, the voting rights of these shares would be “neutralized.” However, the economic rights, including dividends and proceeds from the sale of shares, would still go to Renault until the shares are sold.

In exchange, Nissan has agreed to invest in Ampere, the EV (Electric Vehicle) & Software entity founded by Renault Group.

While Nissan, through its alliance with Renault, aims to maximize shareholder value, the ongoing production headwinds continue to hurt sales.

Nissan’s global production in 2022 decreased by 9.4% year-over-year. Meanwhile, global sales fell by 20.7% in 2022.

By region, sales in Japan (including mini vehicles) declined by 0.5%. Meanwhile, sales outside Japan decreased by 23.2% year-over-year. However, exports from Japan increased by 3.5% in 2022.

Is It Good to Invest in Nissan?

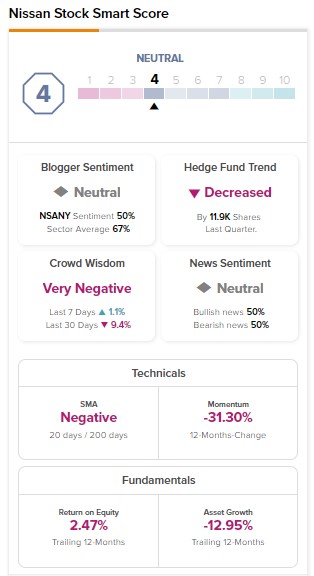

The ongoing production headwinds and global macro weakness could continue to hurt Nissan’s revenue and earnings. Given the short-term challenges, Nissan stock carries a Smart Score of four on TipRanks, indicating a Neutral outlook.