Shares of U.S. Steel (X) are little changed in today’s trading even though Japanese steelmaker Nippon Steel (JP:5401) still expects to close its $14.1 billion buyout of the American steelmaker by the end of the year. Now that the U.S. election has passed, Nippon Steel’s Vice Chairman Takahiro Mori believes discussions on the deal can move forward. He plans to visit the U.S. soon to talk with union leaders, although United Steelworkers’ leader, David McCall, remains against the acquisition.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

U.S. Steel shares have rallied 10% during the past five days alongside other steel stocks on hopes that Trump’s election win could bring back tariffs on steel imports, similar to those he put in place in 2018. Some investors also think Trump may support the deal, but the final decision will likely rest with Biden’s administration.

In September, Nippon Steel extended its review with the Committee on Foreign Investment in the U.S. (CFIUS) to push it past the election. A recent report suggests the Commerce Department no longer sees issues with the deal, which increases the chances that CFIUS will recommend approval by December 22.

Nippon Working Hard to Close the Deal

Nippon Steel has been working very hard to overcome the numerous obstacles it has been facing in order to close the deal. Indeed, it recently announced that it would sell its 50% holding in a joint venture (JV) to ArcelorMittal (MT). It even says it plans to invest billions of dollars into U.S. Steel’s operations in order to improve its efficiency.

Is X Stock a Buy or Sell?

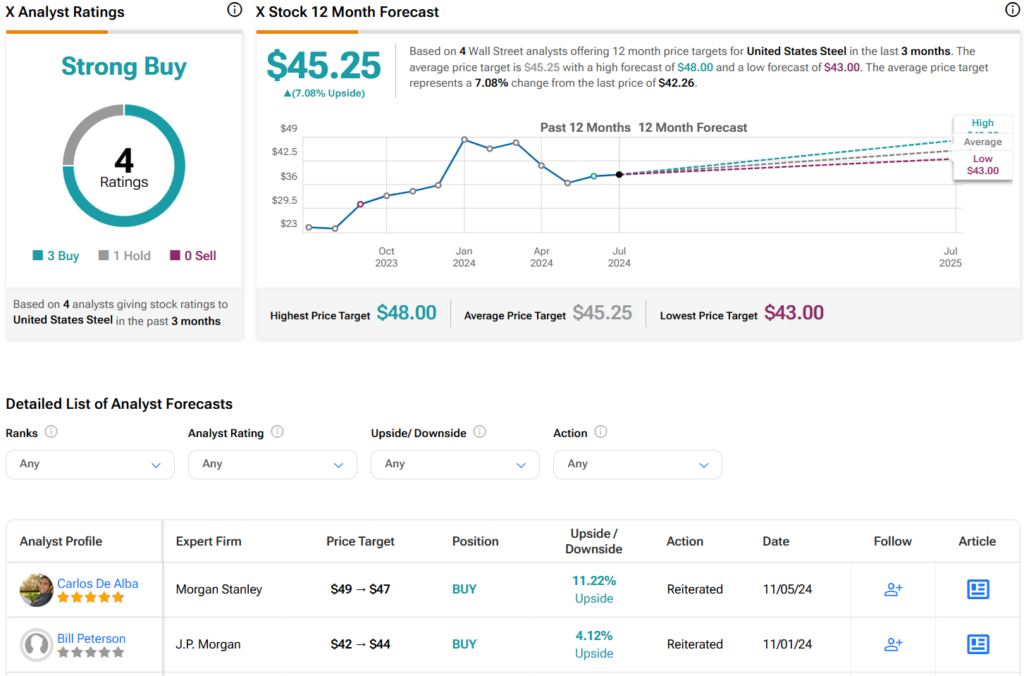

Turning to Wall Street, analysts have a Strong Buy consensus rating on X stock based on three Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 24% rally in its share price over the past year, the average X price target of $45.25 per share implies 7.1% upside potential.