Chinese electric vehicle (EV) manufacturer Nio (NYSE:NIO) is scheduled to release its first quarter Fiscal 2024 results on June 6, before the market opens. The company failed to impress investors with its Q1 delivery figures, as intense competition and macro pressures weighed on EV demand. NIO reported a 3.2% year-over-year decline in Q1 vehicle deliveries, which might have impacted its top-line growth.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Furthermore, the company’s investment to expand the battery-swapping station network and its efforts to counter competition with price cuts may have negatively affected margins during the quarter.

NIO – Q1 Analysts’ Expectations

Ahead of the Q1 results, analyst Tim Hsiao from Morgan Stanley (MS) reiterated a Buy rating on Nio stock with a $10 price target, implying 91.9% upside potential. (To watch Hsiao’s track record, click here.)

The analyst believes that positive management comments on order or margin outlook, along with a favorable update on Onvo, Nio’s low-priced brand launched in May, could drive the stock higher.

Overall, Wall Street analysts expect Nio to report sales of $1.44 billion in Q1, down about 8% year-over-year. Nio’s top line is likely to be hurt by lower vehicle deliveries and price cuts in China. Meanwhile, analysts expect the company to post a loss of $0.3 per share, compared with a loss of $0.35 in the year-ago quarter.

Is NIO a Buy or Sell?

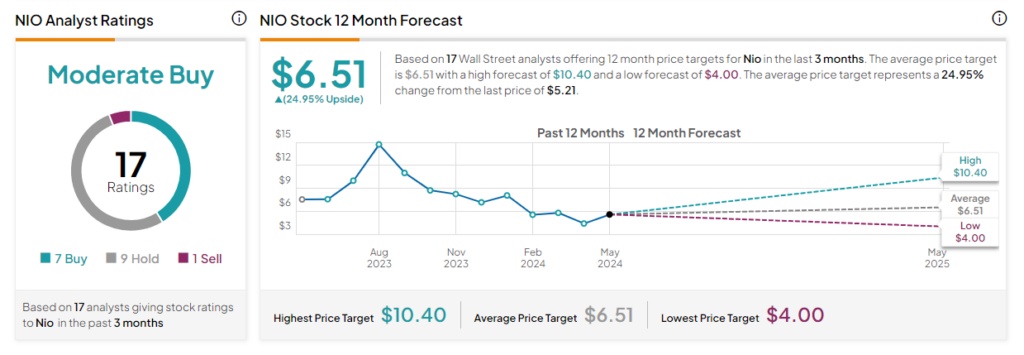

Overall, Wall Street is cautiously optimistic about NIO. The stock has a Moderate Buy consensus rating based on seven Buys, nine Holds, and one Sell rating assigned in the past three months. The analysts’ average price target for Nio stock of $6.51 implies a 24.95% upside potential. The stock is down 30% over the past six months.

Options Traders Expect a Significant Move

Using TipRanks’ Options tool, we can observe traders’ expectations for the stock’s movement following its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. While this may seem complex, the Options tool simplifies the process. This indicates that options traders expect a significant 11.52% movement in either direction.

Concluding Thoughts

Nio’s weak EV deliveries in the first three months of 2024 and recent price cuts could impact its revenues in the first quarter. Moreover, the impact of macro headwinds on consumer spending and increased competition remain concerns. Nevertheless, Nio’s entrance into the low-priced market segment could support its future performance.