Nikola (NKLA) has reached a definitive agreement to acquire Romeo Power (RMO). Romeo is a company that delivers advanced electrification solutions for complex commercial vehicle applications. Under the terms of the agreement, the company will pay $0.74 per Romeo share in the all-stock deal. Following the acquisition news, Nikola stock gained almost 4%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Nikola builds electric trucks for heavy-duty commercial applications. Its vehicles can run on battery power or fuel-cell energy.

Nikola’s Romeo Merger Synergies

Romeo stockholders will receive 0.1186 of a share of Nikola for each share held by Romeo Power, representing an equity value of $144 million. Nikola has also agreed to provide Romeo with $35 million in interim funding to support operations until the transaction closes. The transaction should close by the end of October 2022.

The acquisition should allow Nikola to enjoy operational improvement and cost reduction in the battery pack production business. It should also secure a key battery supply line as it is Romeo’s biggest customer. The company has already started testing battery electric vehicles and fuel cell electric vehicle products.

California-based Romeo has made a name for itself in designing and manufacturing lithium-ion batteries. It also develops battery packs for commercial vehicles. According to Nikola’s Chief Executive Officer (CEO) Mark Russell, Romeo’s acquisition should help accelerate the development of the company’s electrification platform.

Nikola stands to enjoy cost reduction in some of the most expensive components. Due to manufacturing excellence, the company could accrue annual cost savings of up to $350 million over the next four years. It also stands to reduce battery pack costs by 30%-40% by the end of 2023.

According to CNBC, the deal is also a lifeline for Romeo, which had about $66.8 million in cash and equivalents left at the end of the first quarter. The company has also racked up more than $250 million in losses and was running out of options to stay afloat.

Nikola’s Q2 Results are Expected This Week

Nikola is scheduled to report its Q2 results on August 4, 2022. TipRanks estimates a loss per share for the quarter at $0.27. The company is expected to shed more light on the expected synergies of Romeo’s acquisition.

Wall Street’s Take

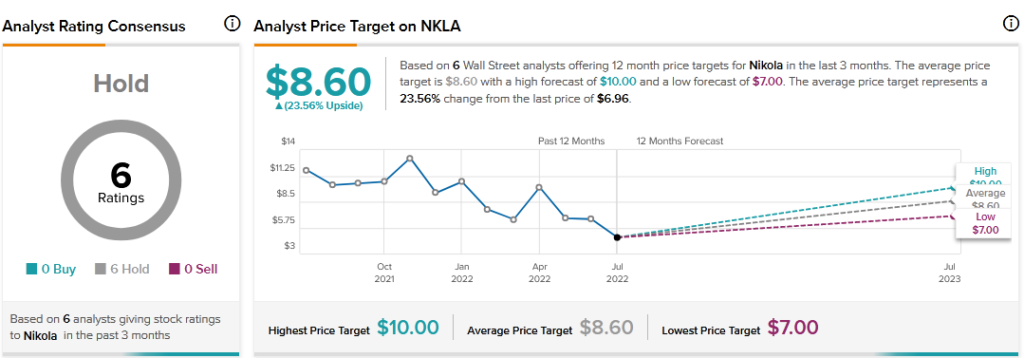

The Street is sitting on the fence with a Hold consensus rating, based on six Holds. The average Nikola price target of $8.6 implies 23.6% upside potential from current levels.

On August 1, RBC Capital analyst Joseph Spak reiterated a Hold rating on Nikola stock with a price target of $8. The analyst’s price target indicates almost 15% upside potential.

Key Takeaway for Investors

With the acquisition of Romeo, Nikola is likely to strengthen its prospects in zero-emission transportation and energy infrastructure solutions. Additionally, the deal should enable the company to secure key battery supply lines and enjoy significant cost savings.

Read the full Disclosure.