NIKE, Inc. (NYSE: NKE), a manufacturer of athletic footwear, apparel, accessories, and equipment, reported upbeat results in the fourth quarter of Fiscal 2022 (ended May 31). The company surpassed both earnings and revenue expectations, which was indicated by TipRanks’ Website Visits tool.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The strong performance of Nike’s direct-to-consumer business led to solid results in the fourth quarter.

Despite the beat, shares of the company declined 2.89% in Monday’s extended trading session following the company’s bleak outlook.

Website Traffic

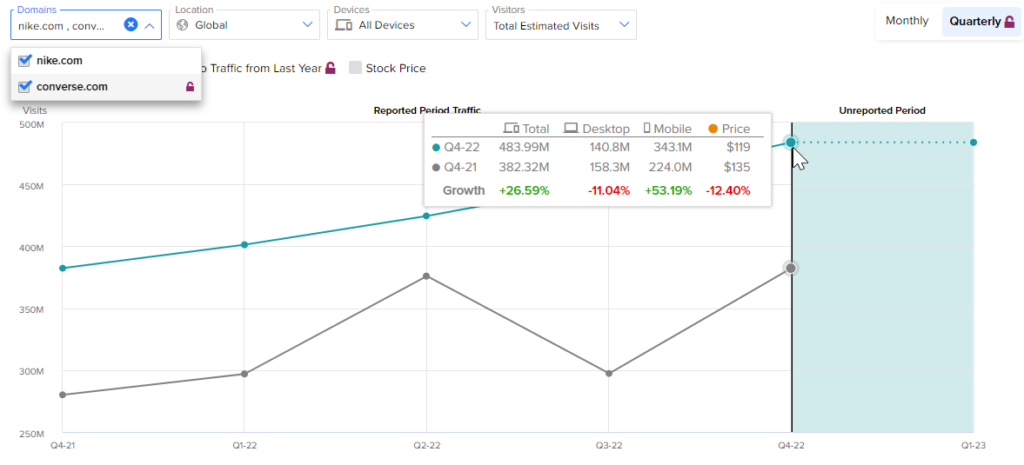

The earnings results were evident on TipRanks’ new tool that measures visits to Nike’s website. Pre-earnings, we were able to see insights into Nike’s performance in the fiscal fourth quarter.

A website traffic uptrend was visible according to the tool. In Fiscal Q4 2022, total visits to Nike websites showed an increasing trend on a global basis, representing a 26.59% jump from the third quarter and a 7.14% increase on a year-over-year basis. This, in turn, indicated that the company might report upbeat results in the fourth quarter.

The predictions that were based on TipRanks’ website visits data turned out to be correct, with Nike reporting better-than-expected results in Fiscal Q4 2022.

Results in Detail

Nike posted earnings of $0.90 per share in the fourth quarter, topping the consensus estimate of $0.81. The company reported earnings of $0.93 per share in the prior-year quarter.

Revenue came in at $12.2 billion, down 1% year-over-year. However, it surpassed analysts’ expectations of $12.1 billion. Revenues for both the Nike Brand and Converse declined 1%, though they were up 3% on a currency-neutral basis.

Revenues at NIKE Direct came in at $4.8 billion, up 7% year-over-year. Meanwhile, wholesale revenues decreased 7% to $6.8 billion.

On a regional basis, revenues in North America were down 5% year-over-year, while EMEA revenues surged 9%. Additionally, revenues in the Asia Pacific & Latin America jumped 15%. However, Greater China sales slumped by 19%.

Gross margin decreased 80 basis points on a year-over-year basis to 45% on the back of elevated input and transportation expenses.

As of May 31, 2022, Nike had $8.4 billion in inventories, up 23% year-over-year. Meanwhile, cash and equivalents and short-term investments were $13 billion.

Capital Deployment

During Fiscal 2022, Nike repurchased 27.3 million shares valued at $4 billion and paid dividends worth $1.8 billion to common shareholders.

In June 2022, Nike’s board authorized a new four-year share buyback program worth $18 billion to repurchase shares of Nike’s Class B common stock. The existing share repurchase program of $15 billion, which was expected to be completed in Fiscal 2023, is replaced by the new program.

CEO’s Comments

In response to the reported results, Nike CEO John Donahoe commented, “NIKE’s results this fiscal year are a testament to the unmatched strength of our brands and our deep connection with consumers. Our competitive advantages, including our pipeline of innovative product and expanding digital leadership, prove that our strategy is working as we create value through our relentless drive to serve the future of sport.”

Guidance

Encouragingly, Nike’s CFO Matthew Friend said, “As we move forward, we will stay focused on what we can control and continue managing the business for the long term. This includes leveraging our scale and financial strength, optimizing supply and demand and most importantly, creating value for our consumer from the products we design to the stories we tell, to the experiences that we deliver.”

Management expects Fiscal 2023 revenues to rise in the low-double-digits on a currency-neutral basis, partly offset by unfavorable foreign exchange movements of about 400 basis points.

In Fiscal Q1 2023, revenue growth is likely to be flat to slightly up on a year-over-year basis.

Wall Street’s Take

The Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 15 Buys and seven Holds. The average Nike price target of $142.05 implies 28.55% upside potential. Shares have lost 26.88% over the past year.

Also, Nike scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Hedge Funds

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Nike is currently Positive, as the cumulative change in holdings across all 35 hedge funds that were active in the last quarter was an increase of 537,000 shares.

Ending Words

Following COVID-related issues in China and the expectation of unfavorable foreign exchange movements to persist, along with supply chain issues, Nike provided a weak outlook. Nevertheless, digital transformation has strongly helped the company’s sales and shows long-term growth prospects. As a result, based on decent analyst ratings and hedge funds’ positive confidence signal, investors might consider the current level as a promising buying opportunity.

Also, vigilance on website trends indicated by TipRanks’ Website Traffic Tool could help investors make wise investment decisions.

Read full Disclosure