NIB Holdings (ASX:NHF) shares were down about 10% in the afternoon, declining to a multiple-month low, as it dipped below AU$6.70. The stock plunged after the Australian health insurance provider detailed a fundraising plan, that would dilute existing shareholders.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

New South Wales-based NIB Holdings has decided to expand its business by entering Australia’s National Disability Insurance Scheme (NDIS). NIB is accelerating its entry into the NDIS through the acquisition of Maple Plan, a plan manager that works between the NDIS, participants and providers. As such, NIB Holdings needs to raise funds.

NIB selling shares at discount to raise money for acquisitions

The company aims to raise AU$150 million to fund its acquisitions, and is tapping into the share market to do so. As part of its fund raising efforts, the company finalised a recent transaction with institutional investors. NIB agreed to sell nearly 20 million new shares below the existing stock’s recent trending price.

The company is considering additional acquisitions in the space, aiming to reach 50,000 participants by 2025.

Although NIB’s fundraising plan may be diluting existing shares, the company believes its entry into the NDIS will pay off. The company expects national NDIS funding to more than double from AU$29 billion in 2022 to AU$59 billion by 2030.

NIB Holdings share price prediction

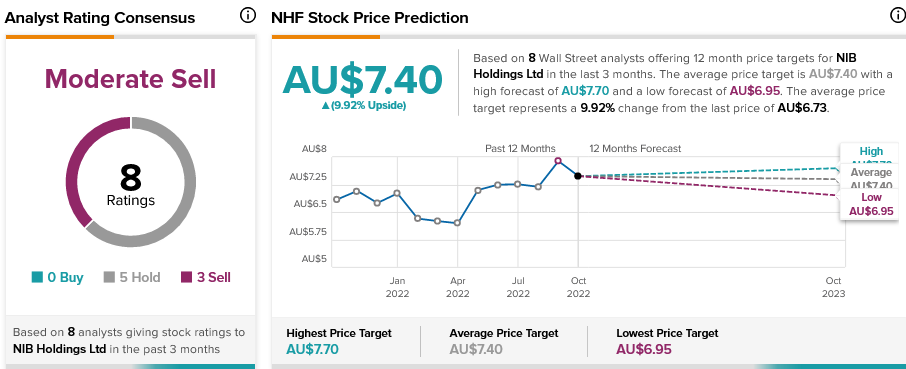

While NIB Holdings may see a sizeable business opportunity in the NDIS program, market sentiment remains subdued. According to TipRanks’ analyst rating consensus, NIB Holdings stock is a Moderate Sell based on five Holds and three Sells. The average NIB Holdings share price prediction of AU$7.40 indicates about 10% upside. The stock has gained nearly 20% in the past six months.

Closing thoughts

NIB Holdings investors haven’t seemed to welcome the dilution of their shares, but the company is pushing on, hoping its move into the NDIS strikes gold.