It’s good news for gold miner Newmont Mining (NYSE:NEM), as it’s managed to land all the necessary government approvals required to acquire Newcrest Mining (OTC:NCMGF). Investors were also overjoyed with the news, and they bought in on Newmont Mining sufficiently to send shares up over 4% in Friday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Newmont had quite a few hoops to go through in order to land its approval to pick up the gold miner. The Australian Foreign Investment Review Board had to sign off, as did several other Australian authorities. Canadian authorities also got involved, as did Papua New Guinea officials. Now, the only thing left is for Newcrest shareholders to vote on the matter, which they’ll do next week. Should the deal pass, it will ultimately close at some point before 2024 dawns.

Once the deal goes through, Newcrest shareholders will get 40% of a Newmont share for each share of Newcrest they currently hold, which will carry an implied value of $29.27 Australian, or about $18.73 U.S.

Is Newmont Mining a Good Stock to Buy?

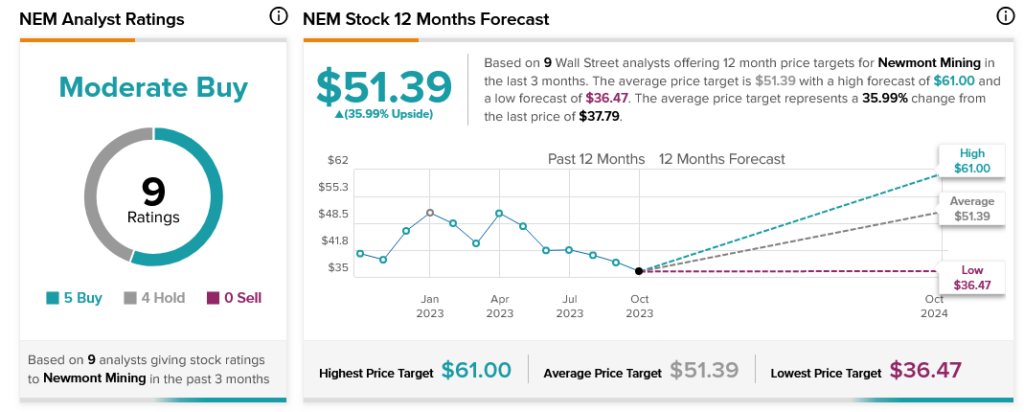

Currently, analyst consensus is running in favor of Newmont Mining, if only just. Newmont Mining stock is currently rated a Moderate Buy, supported by five Buy ratings and four Hold. Further, Newmont Mining also offers investors a 35.99% upside potential thanks to its average price target of $51.39.