Netflix (NFLX) won a shareholder lawsuit that alleged the streaming giant had misled investors about growth forecasts. U.S. District Judge Jon Tigar in San Francisco dismissed the class action lawsuit on the grounds that Netflix’s claims about “roughly 60% penetration” in North America with a lot of growth potential were not false or misleading since they referred only to paid subscribers.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Importantly, the class action was dismissed with prejudice, meaning that the lead plaintiff Fiyyaz Pirani, the trustee of Imperium Irrevocable Trust, cannot amend or file a complaint again. In January 2024 too, an earlier version of the lawsuit was dismissed by the same judge.

Details of the Class Action Lawsuit Against Netflix

In 2022, Netflix cited account sharing as one of the reasons for the lost subscriber base and hence, declining revenues. The judge ruled that the plaintiff’s allegation about account sharing being the main culprit for declining revenues doesn’t hold true. The plaintiff also alleged that Netflix had concealed the extent to which password sharing was hampering its subscriber growth.

In April 2022, when NFLX reported Q1 FY22 results, stating that it lost 200,000 subscribers and expects to lose another 2 million subscribers in the next three months. The entertainment company had blamed account sharing, intense competition in streaming, and exit from Russia due to the ongoing war as some of the reasons for the lost subscriber base. NFLX shares collapsed 35.1% on April 20, 2022, causing massive damage to shareholder returns.

Netflix did crack down on the account-sharing issue back then by limiting the number of users in a single household who can share the account. The measure did help Netflix to boost its revenues and subscribers in the subsequeny quarters.

Is NFLX a Good Stock to Buy?

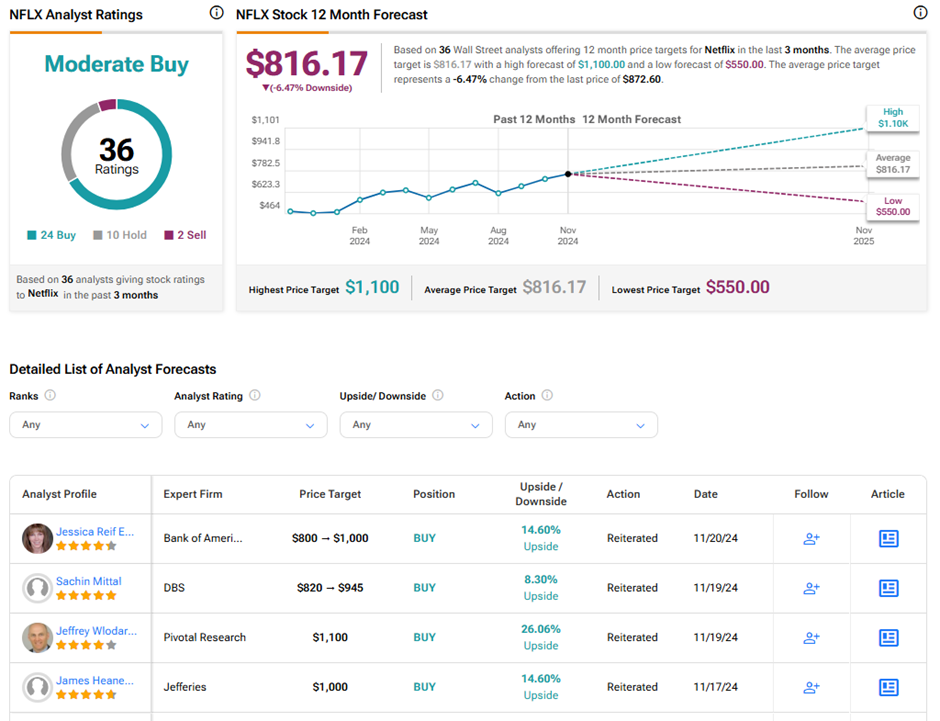

Wall Street remains divided on Netflix stock owing to competition, premium valuation, and its recent decision to stop disclosing subscriber statistics. On TipRanks, NFLX stock has a Moderate Buy consensus rating based on 24 Buys, 10 Holds, and two Sell ratings. Also, the average Netflix stock price target of $816.17 implies 6.5% possible downside from current levels. Year-to-date, NFLX shares have gained 79.2%.