Netflix (NFLX) stock hit a new high after the video streamer announced a big 150% jump in upfront ad sales compared to last year, thanks to its focus on live sports and major shows like Happy Gilmore 2 and Squid Game 2. Upfront ad sales are when advertisers commit to purchasing advertising spots in advance.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company’s recent success in the ad market is driven by upcoming content and new sports deals. Some of its most important deals include NFL Christmas Day games and WWE Raw (TKO). Netflix’s President of Advertising, Amy Reinhard, pointed out that major brands like Amazon (AMZN) and Google (GOOGL) are on board, and the company plans to launch its in-house ad tech platform globally by 2025.

On top of that, analysts, such as Jefferies’ James Heaney, think that Netflix is getting ready to hike its prices due to its move into sports content, which adds to its pricing power. In fact, Netflix has already been pushing customers toward its $15.49 Standard plan by phasing out its cheapest ad-free option.

Is NFLX a Buy or Sell?

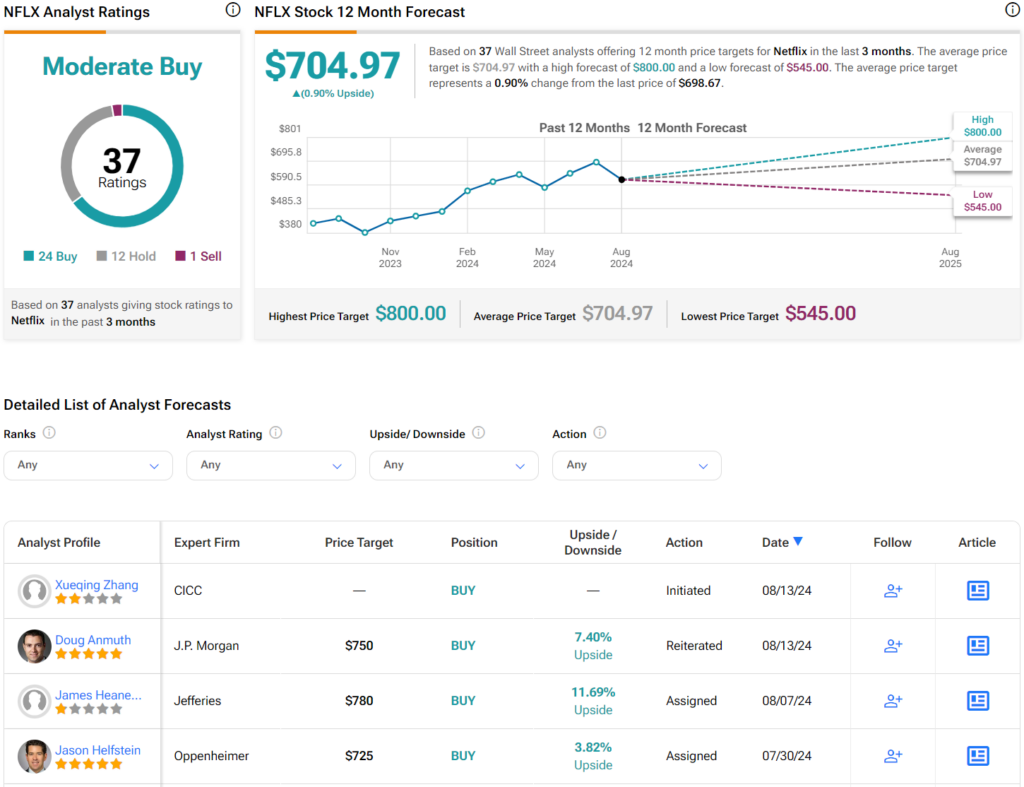

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 24 Buys, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 71% rally in its share price over the past year, the average NFLX price target of $704.97 per share implies 0.9% upside potential.