Today brought an unexpected win for streaming giant Netflix (NFLX), which just celebrated two years since its ad-supported tier of service came out. While it may not be popular with everyone who begrudgingly accepts the advertising as a way to get prices that were roughly similar to what prices were three years ago without advertising, Netflix’s ad-supported tier now boasts over 70 million users worldwide, a CNBC report noted.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The move started back in November 2022 as Netflix looked to help drive subscriber growth. That was also about the time that word of the password-sharing crackdown started up, so it is little surprise that many former password-sharers migrated to the cheapest tier of service they could get.

In fact, the report notes that over 50% of its new sign-ups are for the ad-supported tier. Just last month, Netflix revealed it added 5.1 million new subscribers to its roster for the third quarter. That was well above what analysts were projecting at the time. However, starting in 2025, Netflix will no longer be announcing said numbers, instead focusing on revenue generated and similar measures.

Pause Over Cancel

An odder phenomenon, meanwhile, took shape for Netflix, as well as for other streaming video platforms. It turns out that customers departing their platform of choice are not really departing, so much as they are pausing. A Business Insider report found out that most streaming subscribers who depart the service expect to come back and are leaving their accounts intact, just non-functional, for the time being.

This is not necessarily a new phenomenon; the notion of “streaming nomads” or “streaming hoppers” has been around for a while, where streaming customers go to a service, watch the new content, depart that platform, and go elsewhere to watch the new arrivals there. However, 34.2% of streaming customers routinely rejoin a service they canceled the year prior.

Is Netflix Stock a Good Buy Right Now?

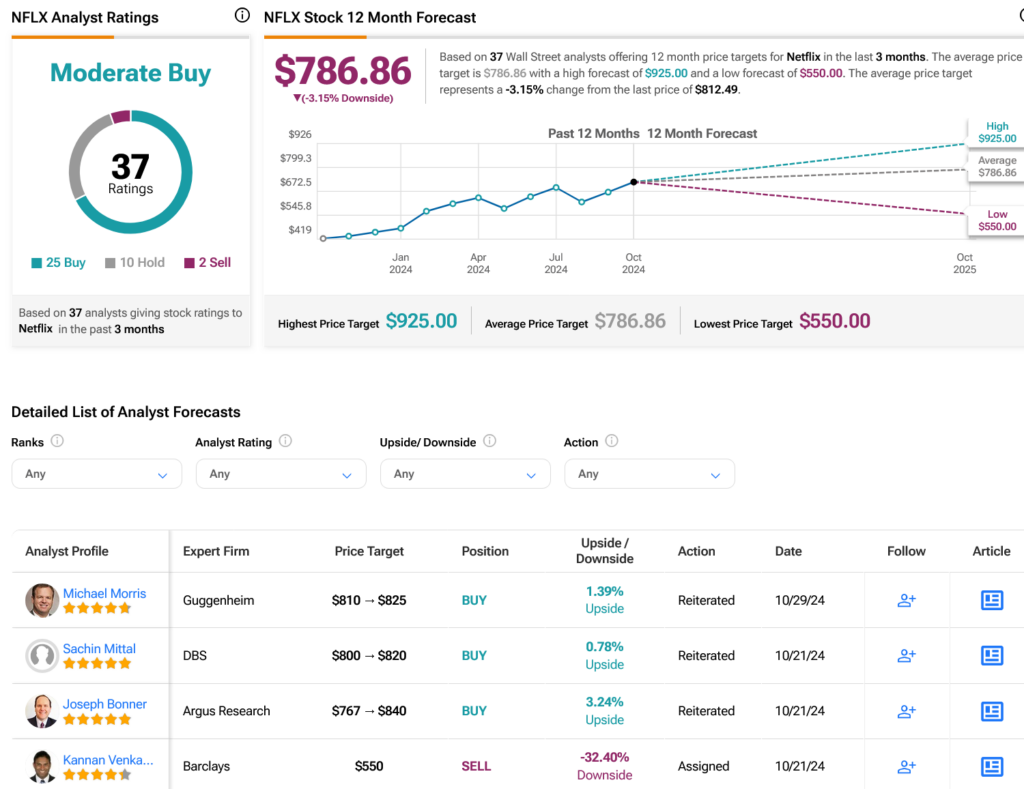

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 25 Buys, 10 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After an 83% rally in its share price over the past year, the average NFLX price target of $786.86 per share implies 3.15% downside risk.