NextEra Energy (NEE) reported adjusted earnings of $0.96 per share, up by 9.1% year-over-year, slightly above consensus estimates of $0.95 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The clean energy company generated operating revenues of $6.07 billion, a decline of 17.4% year-over-year, missing the consensus estimate of $7.3 billion.

CEO’s Comment on the Q2 Results

John Ketchum, NEE’s Chairman, President, and CEO, commented that the company is continuing to invest in its FPL business to support strong customer growth. Ketchum added that NextEra Energy Resources had its second-best origination quarter, securing over 3,000 megawatts of new renewable and storage projects, including 860 megawatts for Google’s (GOOGL) data centers. Furthermore, the CEO stated that both its FPL (Florida Power & Light Company) business and NextEra Energy Resources are experiencing strong tailwinds.

NEE’s FPL Business

NextEra Energy’s (NEE) subsidiary, Florida Power & Light Company (FPL), is the largest power utility in Florida. This utility generated revenues of $4.38 billion in the second quarter, a decline of 8.1% year-over-year. FPL’s revenues comprised more than 70% of NEE’s total revenues in the second quarter.

Furthermore, FPL reported Q2 earnings of $0.60 per share, compared to $0.57 per share in the same period last year.

NEE’s Long-Term Outlook

NextEra Energy expects adjusted earnings per share in the range of $3.23 to $3.43 for 2024. For reference, analysts have projected earnings of $3.41 per share. For 2025, 2026, and 2027, it expects adjusted earnings to be in the ranges of $3.45 to $3.70, $3.63 to $4.00, and $3.85 to $4.32 per share, respectively. The company also aims to grow its dividends per share by about 10% annually through at least 2026, starting from a 2024 base.

What Is the Future of NEE Stock?

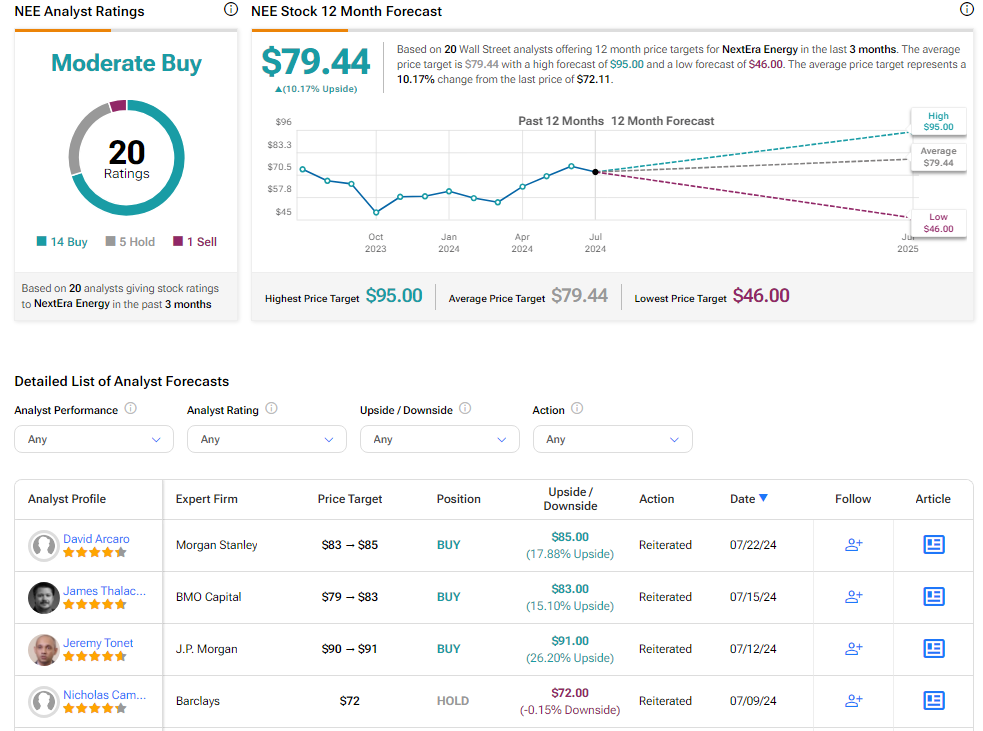

Analysts remain cautiously optimistic about NEE stock, with a Moderate Buy consensus rating based on 14 Buys, five Holds, and one Sell. Year-to-date, NEE has increased by more than 15%, and the average NEE price target of $79.44 implies an upside potential of 10.2% from current levels. These analyst ratings are likely to change following NEE’s Q2 results today.