Shares of data center operator Nebius (NBIS) tumbled by over 8% on Wednesday afternoon despite the company’s new $3 billion deal with U.S. tech giant Meta Platforms (META) and a 355% year-over-year rise in revenue in its third-quarter 2025 results. Yet, two five-star analysts remain confident that NBIS stock is worth buying.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nebius, Other Neocloud Stocks Fall

On Tuesday, Nebius’s shares initially accelerated after the deal that will see it supply graphics processing unit (GPU) capacity to Meta became public for the latter’s AI workloads. However, its stock wrapped up Tuesday trading over 7% lower, even as rivals CoreWeave (CRWV) and IREN Limited (IREN) also went down by 16.31% and 4.64%, respectively.

With regard to Nebius, which is backed by American chip design heavyweight Nvidia (NVDA), investors appear to have focused on the AI cloud company’s inability to turn its net loss of $100.4 million from a year ago into profit.

This is even though Nebius saw its net loss fall dramatically to $39.7 million during the recent three-month period. Moreover, Nebius’s revenue, despite jumping dramatically from a year ago, came in below Wall Street’s consensus forecast of $155.1 million.

Why Wall Street Is Bullish on Nebius

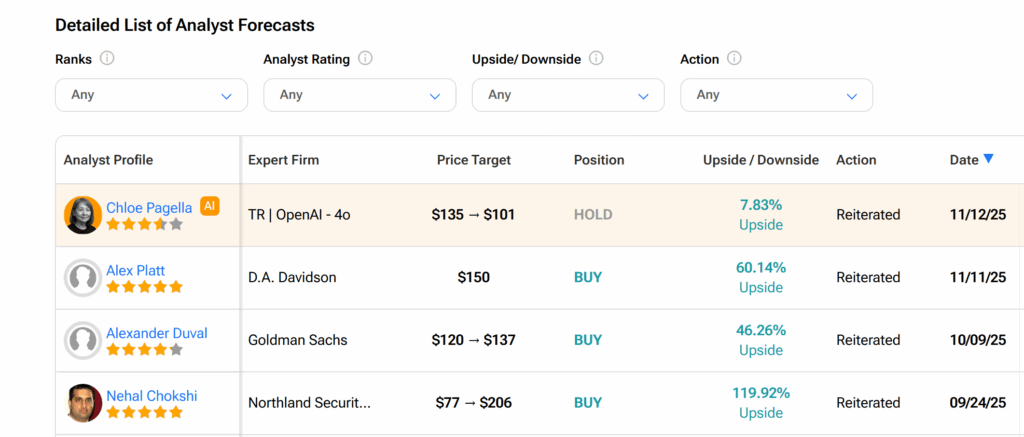

Reacting to the Wall Street result, DA Davidson analyst Alexander Platt reaffirmed his Buy rating on NBIS stock, maintaining his $150 price target — which implies over 61% upside potential. Platt pointed to Nebius raising its guidance for power contracts expected by the end of its Fiscal Year 2026.

The five-star analyst also pointed to the Amsterdam-based company’s expectations of generating between $7 billion and $9 billion in its next fiscal year as a reason for the Buy rating.

The analyst noted that the company continues to prove that it is receiving elevated demand for its facilities across all its data center regions and across GPU generations. This is even as Nebius has contracted out “significant capacity” and plans to bring more capacity online by its next fiscal year, Platt said.

Chipping in, Northland Securities analyst Nehal Chokshi also raised his price target to $211 from $206 and stuck to his Outperform (Buy) rating on NBIS stock. Chokshi pointed to the company’s “impressive” numbers on the reliability of its systems, which helped the data center operator sell out all its capacity in Q3, with the same expected in the coming quarter.

Furthermore, the five-star analyst pointed out that he is confident in Nebius’s plan to add around 38 to 55 megawatts of new power by December. He also pointed to the company’s plan to increase total contracted power by 1.5 gigawatts by the end of next fiscal year.

Is NBIS Stock a Good Investment?

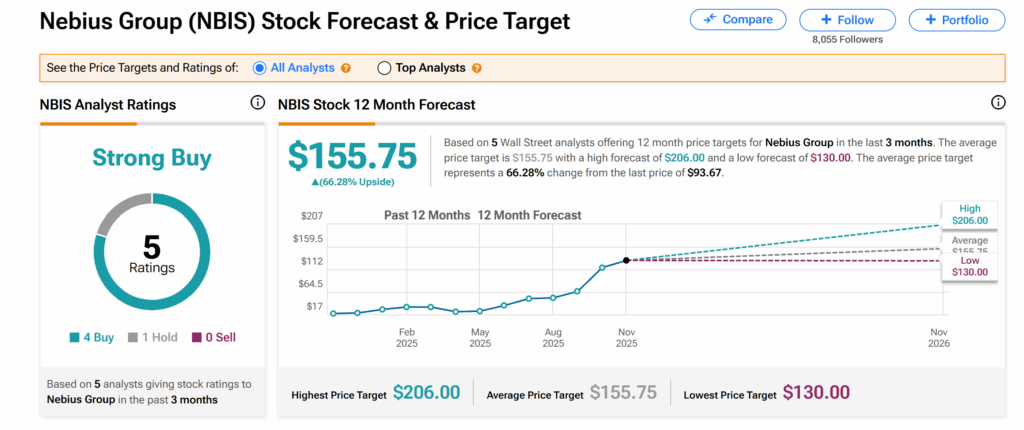

Nebius is also enjoying a positive sentiment across Wall Street. Its shares currently boast a Strong Buy consensus rating based on four Buys issued and one Hold issued over the past three months.

Moreover, at $155.75 per share, the average NBIS price target indicates more than 66% growth potential from the current level.