Nebius’s (NBIS) shares powered up more than 5% during early trading on Tuesday after the data center operator revealed that it has signed a five-year contract to deliver AI infrastructure to U.S. tech giant Meta Platforms (META).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Amsterdam-based company also released its third-quarter 2025 financial results, showing that its revenue skyrocketed by more than 355% from a year ago to reach $146.1 million. However, the revenue figure came in below Wall Street’s consensus forecast of $155.1 million.

Nebius Inches Closer to Profitability

Similarly, Nebius, which is backed by American chip design colossus Nvidia (NVDA), continued to record adjusted net losses during the recent quarter. It reported a net loss of $39.7 million. However, the figure shrank considerably from $100.4 million posted during the same period last year.

Nebius’s deal with Meta is its latest major contractual agreement after it was revealed early last month that its arrangement with Microsoft (MSFT) — first revealed at the start of September — was worth about $19.4 billion.

While the terms of its new contract with Meta remain unclear at this time, its partnership with Microsoft will see it supply the American multinational technology company with access to over 100,000 Nvidia GB300 chips.

Nebius Strengthens Position in AI Cloud Race

Since the start of the year, Nebius’s shares have soared more than 400%, reaching about $115.80 per share as of early trading on Tuesday.

Nebius is one of several neo-cloud providers, such as IREN Limited (IREN) and CoreWeave (CRWV), that have emerged to provide the AI infrastructural power needed by Big Tech companies to power up their gigantic AI workloads.

Last week, the company rolled out the Nebius Token Factory, its new AI platform targeted at institutional users. The Factory empowers businesses to deploy, optimize, and scale their open-source and custom artificial intelligence models.

Is NBIS Stock a Good Investment?

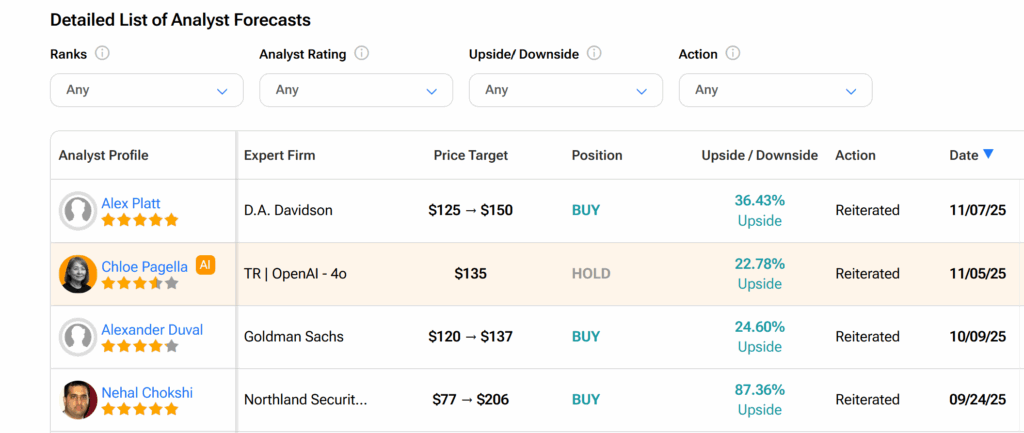

On Wall Street, Nebius’s shares currently enjoy a Strong Buy consensus rating based on four Buys issued by analysts over the past three months. At $155.75 per share, the average NBIS price target suggests almost 42% upswing from the current level.