Big tech companies may have to renege on their clean energy promise and use power generated from natural gas to fuel new electric demand from AI projects. This could mean that those who made aggressive sustainable energy pledges may have to bend and adopt natural gas as an interim fuel to match their industry’s appetite for artificial intelligence (AI).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The sudden AI race and rapid expansion of the technology and its many applications have placed unprecedented demands on energy resources. The energy sector is now under pressure to quickly address growing demand. Meanwhile, tech companies like Amazon (NASDAQ:AMZN), IBM (NYSE:IBM), Microsoft (NASDAQ:MSFT), and Meta (NASDAQ:META) have long committed to powering their data centers with renewables to slash carbon emissions. Currently, solar and wind alone are inadequate to meet the needed electric demands.

The Energy Problem

The problem for the energy industry is that, after a decade of flat power demand in the U.S., electricity needs are now expected to increase by as much as 20% by 2030. Electric generating companies were already scrambling to build out capacity to meet the expansion of domestic semiconductor and battery manufacturing. Additionally, with an increasing number of electric vehicles hitting the road, the demand for charging infrastructure is also on the rise.

AI data centers alone are expected to add about 323 terawatt hours of electricity demand by 2030 in the U.S. To paint a clearer picture, the forecasted power demand from AI alone is seven times greater than New York City consumes in a year. In fact, Goldman Sachs (NYSE:GS) has predicted that data centers will represent 8% of total U.S. electricity consumption by the end of the decade.

Tech giants like Google (NASDAQ:GOOGL) have pledged to match their power use with clean energy sources by 2030. However, as AI transforms their business strategies and energy assumptions, meeting these goals becomes increasingly challenging. The question they’re faced with is whether they can maintain their commitment to sustainability while continuing to quickly adopt AI.

Natural Gas: A Bridge to a Sustainable Future

This is where natural gas begins to smell really good to big tech companies. While not a zero-carbon solution, natural gas burns cleaner than coal, which makes it a more environmentally friendly option compared to traditional fossil fuels. It also offers the advantage of being reliable and affordable, a critical factor for utility companies struggling to meet surging electricity production demands.

Natural Gas Demand on the Rise

The natural gas industry is well aware of this golden opportunity and is gearing up to meet the rising output needs.

Experts predict a natural gas demand surge of 10 billion cubic feet per day by 2030, a staggering 28% increase from current levels. The Southeast United States is expected to be a major hub for data center construction. This will further fuel the demand for natural gas power generation in the region.

Investment Opportunities in Natural Gas

As the demand for energy skyrockets, especially green energy, natural gas as a cleaner bridge is predicted to benefit significantly from the increasing demand. Simply put, natural gas offers a practical and realistic solution until wind and solar production can catch up.

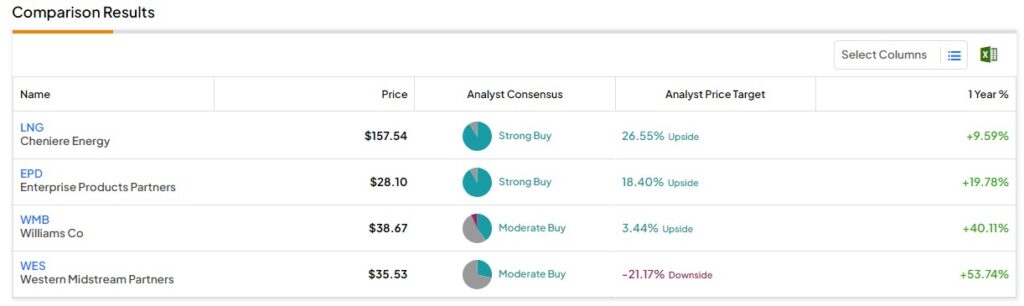

Stock market investors looking to gain exposure to natural gas production or infrastructure companies can utilize the TipRanks Comparison Tool to explore analysts’ evaluations of a few such companies.

Among these natural gas stocks is Cheniere Energy (NYSE:LNG), which is the biggest liquid natural gas producer in the U.S. and the second-largest globally. Meanwhile, Enterprise Product Partners (NYSE:EPD) specializes in transporting and processing natural gas, and Williams Co. (NYSE:WMB) focuses on owning and operating natural gas pipelines as its core business. In contrast, Western Midstream Partners (NYSE:WES) gathers, processes, transports, and disposes of hydrocarbons, including natural gas.

All of these stocks are in different businesses within the sector and have earned either a Strong or Moderate Buy Analyst Consensus.

Key Takeaway

The surging electricity demands of AI data centers pose a challenge for utilities striving to use only “sustainable” energy by 2030. Natural gas, though not a perfect solution, offers a cleaner and more reliable bridge, compared to traditional fossil fuels, until renewable energy infrastructure catches up.

This trend presents potential investment opportunities in the natural gas sector.