The Dow Jones Industrial Average (DJIA) took a beating today as investors reacted to the latest earnings reports and economic data.

Leading today’s negative news is Walmart (WMT) with its Q4 earnings report. While the retail giant beat EPS estimates for the quarter it provided weak guidance for Fiscal 2026. This upset investors, causing WMT and other retail stocks to fall today. Another blow came from the Federal Reserve’s meeting minutes released yesterday, showing that rising inflation will likely delay interest rate cuts.

All of this news has a significant effect on the DJIA, which is down a staggering 1.48% as of this writing. Even so, the index is still up 1.7% over the last three months and remains up 4.9% year-to-date.

Which Stocks Hit the DJIA Index Today?

Turning to the TipRanks Dow Jones heatmap tool, traders will see which stocks kept the index down on Thursday. As mentioned above, Walmart stock is weighing on the index with a 6.43% drop. The financial sector is also performing poorly with JPMorgan Chase (JPM) down 4.63%, American Express (AXP) falling 2.74%, Goldman Sachs (GS) diving 5.09%, and Visa (V) dipping 1.6%. There’s also a fair bit of red across technology, healthcare, consumer cyclical, and industrial sectors today.

How to Invest in the DJIA

Investors can’t take a direct stake in the Dow Jones as it’s only an index. Instead, they might consider buying shares listed on it. With all the drops today, this might be a good time to pick up falling shares before a recovery. Another option is buying stocks resilient enough to rise today in hopes of further profits.

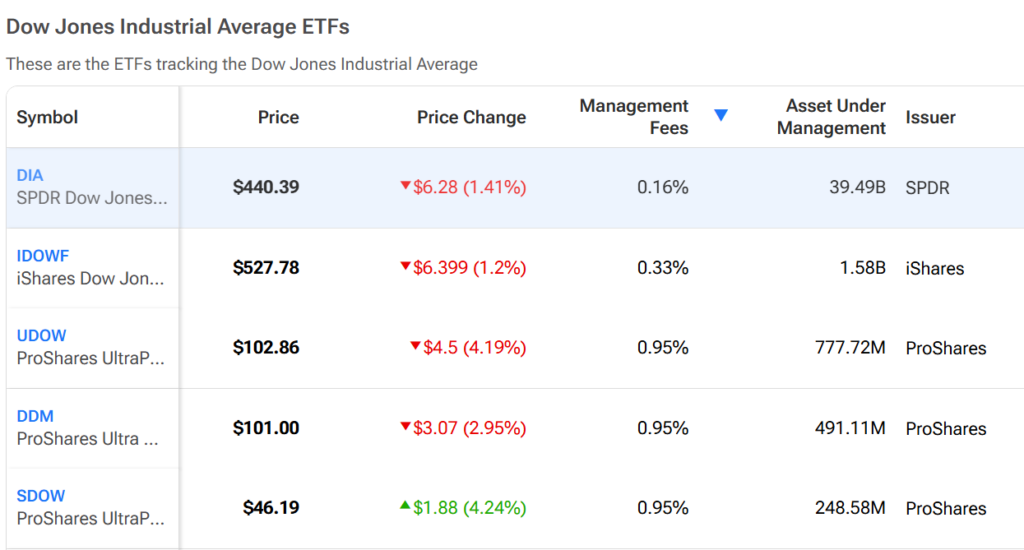

A third option for investors is buying shares of exchange-traded funds (ETFs) that track the DJIA. SPDR Dow Jones Industrial Average ETF Trust (DIA) is one popular choice among traders but several other options are available.

Questions or Comments about the article? Write to editor@tipranks.com