Domino’s Pizza (DPZ) stock has fallen 18% over the past six months but is still higher by 17% over the past year. Interestingly, volatility has been relatively low with a 24m Beta of 0.89. The company operates a tried-and-tested business model with low capital expenditures and strong royalties from its franchises. Despite growth expectations from some investors, I’m concerned about the longevity of a company that makes 2,000-calorie pizzas in an increasingly health-conscious world. Moreover, I’m bearish on the valuation metrics that look expensive.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Domino’s Successful Business Model

Most people know Domino’s Pizza, but may not realize that the company’s business model is primarily based on franchising, with 99% of its locations owned and operated by franchisees. This model allows Domino’s to generate revenue through royalties while minimizing capital expenditures, resulting in strong free cash flow. In fact, capital expenditures only represent 2.4% of sales. The company’s global presence spans over 20,900 outlets in more than 90 markets.

In recent years, Domino’s has put increasing emphasis on efficient operations and technology integration to enhance the customer experience and drive sales. The company has also invested in digital ordering platforms and delivery services.

Is Domino’s Pizza Still Growing?

A quick look at the company’s recent earnings and revenue history suggests that Domino’s Pizza isn’t growing terribly quickly. In the last two quarters, the company reported year-on-year revenue growth of 7.1% and 5.9%, but that followed growth of 0.7% and declines of 3.9% and 3.8% back in Q3 and Q2 of 2023. It’s easier to have a bearish view of a stock when the company isn’t posting consistent growth.

Nonetheless, some analysts are continuing to strike a bullish tone, given that the global pizza market, according to analysis by Technavio, is projected to reach $217.15 billion by 2027, with a CAGR of 6.26% from 2022 to 2027. Domino’s plans to expand its store count, aiming to open more than 175 net new stores per year in the U.S. from 2024 to 2028. Although international growth expectations have been lowered, the company still anticipates some expansion.

Moreover, the company is introducing new menu offerings, such as the New York Style Pizza, and has improved its loyalty program to drive growth. It has also partnered with Uber Eats (UBER), opening up new opportunities. The company expects Uber Eats to account for 3% or more of sales by the end of the year.

My European Skepticism

I’m inherently skeptical about the future longevity of fast-food companies, especially American companies, in an increasingly health-conscious world. Clearly, Domino’s isn’t known for delivering healthy food. Several of the larger pizzas contain more than 2,000 calories, and several medium-sized pizzas contain more calories than most peoples’ Recommended Daily Allowance. In my rather extreme opinion, these are products that are undertaxed in societies where healthcare is universal.

Moreover, the global pizza market is shifting towards gourmet and artisanal offerings, with consumers seeking unique and premium dining experiences. Domino’s pizzas bear little resemblance to traditional Italian offerings, and thankfully traditional Italian pizzas are much easier to find in North American markets than they were just two decades ago.

Younger generations, particularly millennials and Gen Z, prefer organic or free-range food and are willing to pay a premium for sustainably sourced ingredients. This shift in consumer preferences could potentially impact Domino’s traditional fast-food model and market share.

Domino’s Pizza Valuation

You’d expect a company that’s been growing fairly slowly to be cheap, but that doesn’t appear to be the case. The stock is currently trading at a forward P/E of 26.3x, representing a 53.7% premium to the consumer discretionary sector. Moreover, with medium-term growth expected to average 10.8% per annum, the price-to-earnings-to-growth (PEG) ratio currently sits at 2.4. That’s expensive and the 1.4% dividend yield isn’t captivating.

Domino’s is expected to deliver its Q3 results on October 10, with analysts projecting normalized earnings per share (EPS) of $3.65, down 12.5% year-over-year. There have been 21 downward revisions and just seven upward revisions to the forecast in the last 90 days.

Is Domino’s Pizza Stock a Buy According to Analysts?

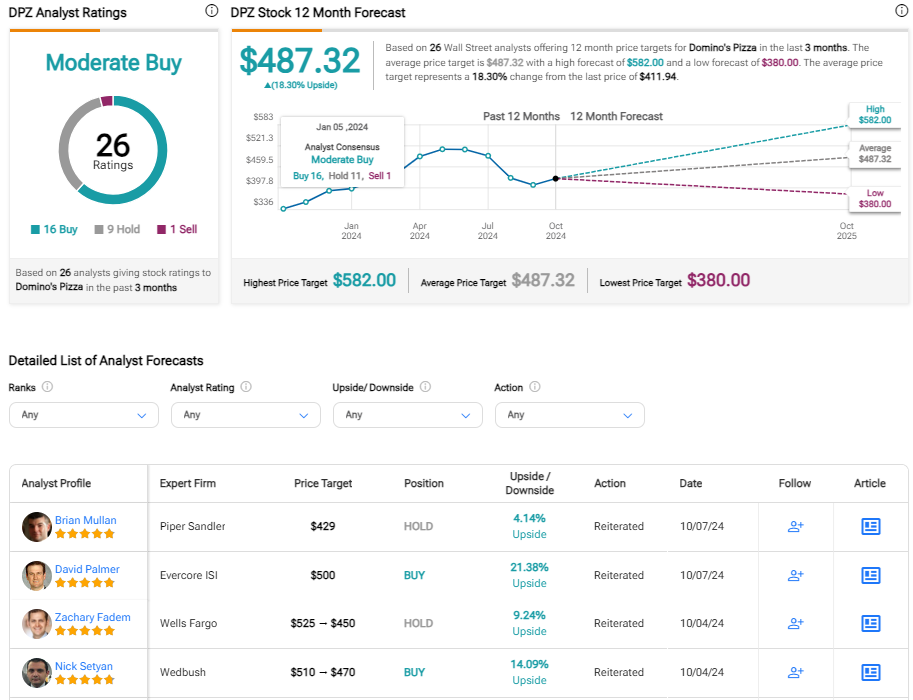

On TipRanks, DPZ comes in as a Moderate Buy based on 16 Buys, nine Holds, and one Sell rating assigned by analysts in the past three months. The average DPZ stock price target is $487.32, implying potential upside of 18%.

For investors wondering which Wall Street analyst to follow regarding DPZ stock, Chris O’Cull of Stifle Nicolaus has a successful history regarding his calls. TipRanks measures that for DPZ he has had a 92% success rating over the past 2 years, with an average return of 32.24%.

The Bottom Line on Domino’s Pizza Stock

Domino’s Pizza stock may trade with a healthy discount to its average share price target, but I think the stock is expensive. I’m also concerned about the longevity of businesses that compete against trends for healthier and more authentic meals. I appreciate many investors will be attracted by its capital-light business model and household brand status, but I hold a bearish view of DPZ stock.