A catastrophe. That’s about the only way to describe biotech stock Design Therapeutics (NASDAQ:DSGN) and its Tuesday afternoon trading session. Design Therapeutics lost just over 70% of its value on Tuesday, and it’s mostly thanks to two analyst downgrades, and what they represented.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Both RBC Capital and Wedbush cut their ratings on Design Therapeutics, with RBC cutting the rating to “sector perform” and Wedbush pulling back to “neutral.” RBC Capital pointed out that Design Therapeutics really didn’t have that many “near-term catalysts” for improving the stock’s outlook. Design Therapeutics’ flagship drug, DT-216, was undergoing a reformulation, and that didn’t leave much else in the tank for the company to actually sell. In fact, as a result, RBC Capital doesn’t look for DT-216 to actually hit markets until 2029. RBC also gives it a 10% chance of success.

That’s an opinion Wedbush shares, as it too noted that the Design Therapeutics treatment for Friedrich ataxia would have to be pushed back until “at least” fiscal 2029. While Design Therapeutics did offer some positive data out of its Phase 1 testing, that wasn’t enough to overcome the troubles faced by the drug. That includes injection site reactions, and is also likely enough to keep DT-216 in fresh testing until at least 2025’s first half. Both also slashed their price targets, with RBC going from $23 to $7, and Wedbush going from $19 to $6.

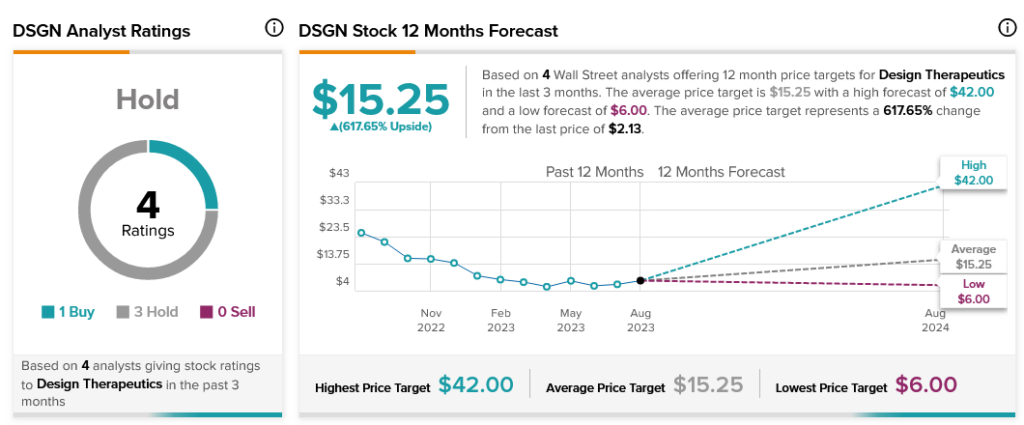

With the recent adjustments, Design Therapeutics’ position in analyst consensus has slipped, somewhat. With one Buy rating and three Hold, Design Therapeutics stock is considered a Hold by analyst consensus. Further, with an average price target of $15.25, Design Therapeutics stock boasts a staggering 617.65% upside potential.