Shares of MSCI Inc. (MSCI) have dropped 12.5% so far this year. The company provides decision support tools and services for global investment participants. MSCI’s recent fourth-quarter performance came in ahead of expectations on both its top-line and bottom-line fronts.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Boosted by double-digit growth in recurring subscription revenues and asset-based fees, revenue increased 24% year-over-year to $549.8 million, outperforming estimates by $9.8 million. Earnings per share at $2.51 beat consensus by $0.02.

Notably, in Q4, MSCI witnessed new recurring subscription sales growth of 43.1% and a retention rate of 94.4%. Notably, this was the 32nd consecutive quarter of double-digit subscription growth in the company’s index business.

With these developments in mind, let us take a look at the changes in MSCI’s key risk factors that investors should know.

Risk Factors

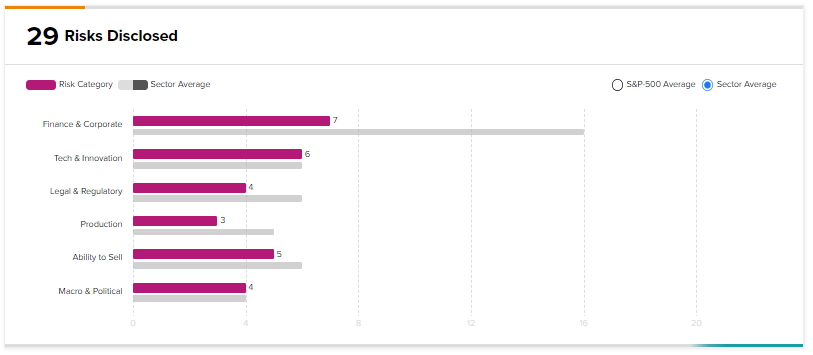

According to the TipRanks Risk Factors tool, MSCI’s top risk category is Finance & Corporate, contributing 7 of the total 29 risks identified for the stock, compared to a sector average of 16 risk factors under the same category.

In its recent report, the company has added one key risk factor under the Tech & Innovation risk category.

MSCI noted that in order to remain competitive it needs to continuously introduce new products and services, enhance existing offerings and generate customer demand for new introductions.

The risk remains that MSCI may not achieve this in a cost-effective manner, or on a timely basis, or its products may not gain market acceptance. These are long-term investments with no certainty of the anticipated performance and sales.

Additionally, the company’s reputation may be harmed if it is perceived to not innovate fast enough for the market’s requirements.

Hedge Fund Activity

According to TipRanks data, the Wall Street’s top hedge funds have decreased holdings in MSCI by 34.2 thousand shares in the last quarter, indicating a negative hedge fund confidence signal in the stock based on activities of 14 hedge funds. Notably, Ken Fisher’s Fisher Asset Management has a holding worth $126 million in MSCI.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Dutch Regulator Fines Apple $5.7M – Report

Kroger and Kitchen United Open Second Kitchen Center in Texas

AT&T Joins Ericsson’s Startup 5G Program