Shares of Marvell Technology (MRVL) jumped over 7% in after-hours trading yesterday after the semiconductor company reported a healthy beat for Q2 FY25 (ended August 3, 2024) and better-than-expected Q3 guidance. Marvell is finally seeing an uptick in demand for its artificial intelligence (AI) products after months of sluggish growth.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Marvell’s products serve five end markets, including data centers, enterprise networking, carrier infrastructure, consumer, and automotive/industrial.

Marvell Surpasses Q2 Expectations

Marvell’s Q2 FY25 revenues of $1.27 billion fell 5.1% year-over-year but beat the consensus of $1.25 billion. Similarly, adjusted earnings per share (EPS) of $0.30 declined 9.1% year-over-year but exceeded the consensus of $0.29.

The company’s data center revenues registered a massive leap of 92% year-over-year to reach $880.9 million. Marvell was able to report Q2 revenues above the midpoint of its own guidance thanks to robust demand for AI products, especially for electro-optics products and custom AI programs.

Marvell Issues Upbeat Q3 Outlook

For Q3 FY25, Marvell expects revenue of $1.45 billion (+/- 5%), exceeding the consensus of $1.40 billion. Furthermore, adjusted EPS is forecasted at $0.40 (+/- $0.05), which also exceeded the consensus of $0.38.

CEO Matt Murphy said that the company expects the data center end market growth to accelerate in the third quarter. Additionally, Marvell projects that the combined enterprise networking and carrier end markets will return to growth in Q3 FY25.

Analysts React Positively to MRVL’s Results

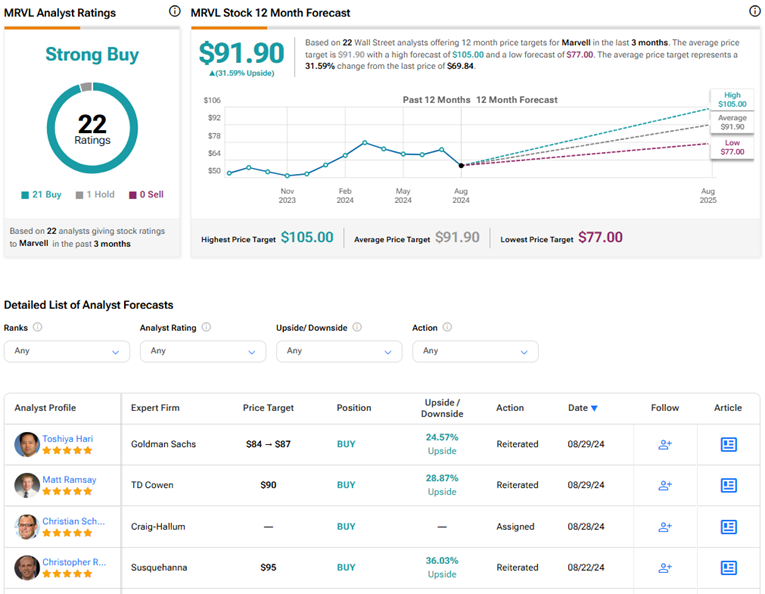

Following Marvell’s solid Q2 print, Goldman Sachs analyst Toshiya Hari lifted the price target on the stock to $87 from $84, implying 24.6% upside potential. Hari is impressed by management’s confidence in AI revenues and the expected ramp-up in the Enterprise Networking and Carrier Infrastructure segments.

Similarly, TD Cowen analyst Matt Ramsay reiterated a Buy rating on MRVL stock with a price target of $90, implying 28.9% upside potential from current levels. Ramsay is optimistic about the growth of MRVL’s data center revenues, fueled by AI.

Is Marvell a Good Investment?

On TipRanks, MRVL stock has a Strong Buy consensus rating based on 21 Buys and one Hold rating. The average Marvell Technology price target of $91.90 implies 31.6% upside potential from current levels. MRVL shares have gained 16.1% so far this year.