Tesla (NASDAQ:TSLA) shares have been enjoying an extended moment in the winter sun following Trump’s election win. Since November 5, the stock has already surged by 38%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The momentum continued this week, bolstered by a Bloomberg report stating that Trump’s transition team has informed advisors that establishing a federal framework for fully autonomous vehicles will be a priority for the Transportation Department. This development aligns with Tesla’s autonomous vehicle ambitions and has fueled optimism among investors about Elon Musk’s potential role in influencing policies critical to the company’s growth.

Morgan Stanley analyst Adam Jonas notes that the recent surge in Tesla’s stock underscores the type of catalysts that often drive volatility in TSLA shares.

While Jonas believes the potential reduction in IRA consumer tax credits may already be factored into the stock price, he argues that Tesla’s “leadership in embodied AI and autonomous technology” along with potential policy drivers, may not yet be fully reflected in the shares.

That said, investors should keep a lid on expectations regarding a speedy path to autonomous driving getting the go-ahead. While Jonas thinks a reassessment of national self-driving policies is an inevitability, the analyst believes Tesla still faces “significant hurdles to overcome” related to technology, testing, and the permitting necessary for commercialization. Additionally, Jonas anticipates that individual US states and metropolitan areas will “continue to have the greatest say on final deployment.”

The analyst also notes that his TSLA projections through 2030 do not factor in any production of the Cybercab, and his Network Services and Mobility forecasts exclude fully unsupervised FSD in “any appreciable commercial scale.”

In Jonas’ SOTP (sum-of-the-parts) model, he values Tesla Mobility (rideshare) at slightly over $50 per share. “We do not implicitly assume mass deployment of autonomous vehicles in our Tesla Mobility forecast until the mid 2030s,” the analyst further said.

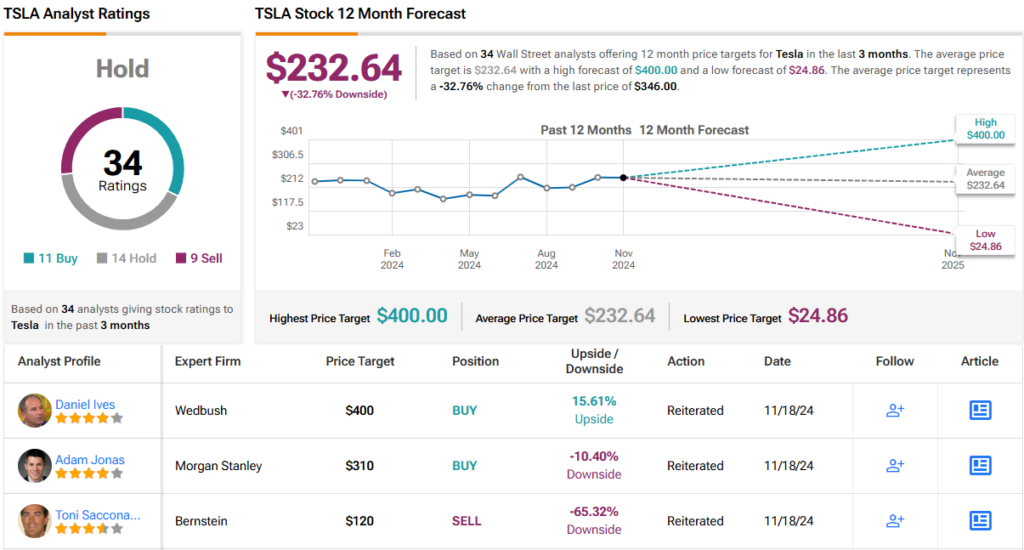

So, what does this ultimately mean for investors? Jonas rates Tesla shares an Overweight (i.e., Buy), although his $310 price target implies the stock is now overvalued by 10%. (To watch Jonas’ track record, click here)

Broadly, the analyst consensus offers a mixed view. Of 34 analysts covering TSLA, 10 rate it a Buy, while 16 recommend a Hold, and 8 suggest a Sell. This balance leans toward a Hold (i.e. Neutral) consensus rating. Most analysts believe the stock’s recent rally has pushed it too high, with the average price target of $232.64 sitting ~33% below the current trading price. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.