Morgan Stanley (NYSE:MS) has been fined £5.41 million or $6.82 million to settle an investigation by the UK’s energy markets regulator for record-keeping lapses, a Wall Street Journal report highlighted.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

It is worth highlighting that the UK’s Office of Gas and Electricity Markets, or Ofgem, fined Morgan Stanley as its traders were using unauthorized apps, including Meta Platforms (NASDAQ:META)-owned WhatsApp, for discussing energy market transactions. This breach resulted in non-compliance with book-keeping regulations. Morgan Stanley agreed that between 2018 and 2020, its traders used WhatsApp on their phones to discuss transactions.

Besides for Morgan Stanley, Wells Fargo (NYSE:WFC), BNP Paribas (BNPQY)(FR:BNP), and several other financial services firms were recently fined millions of dollars in the U.S. for using unapproved messaging apps and breaking record-keeping rules. Together, these firms agreed to pay nearly $555 million in fines.

While Morgan Stanley is fined over using unapproved messaging apps, the financial services giant is benefitting from the strength in the Wealth Management segment, with net new assets growing by $90 billion in the second quarter. Against this background, let’s check what the Street recommends for Morgan Stanley stock.

Is Morgan Stanley a Good Stock to Buy Now?

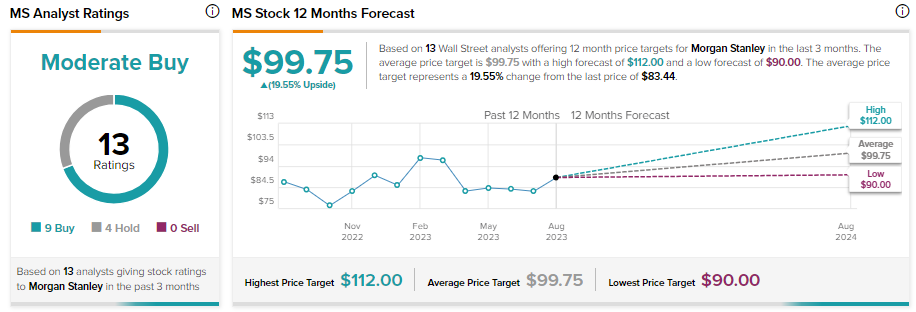

Analysts are cautiously bullish about Morgan Stanley stock. The company is expected to benefit from the ongoing strength of its Wealth Management division. Further, its strong capital positioning and solid balance sheet augur well for growth. However, near-term macro uncertainty and higher funding costs pose challenges.

With nine Buy and four Hold recommendations, Morgan Stanley stock has a Moderate Buy consensus rating on TipRanks. Further, analysts’ average price target of $99.75 implies 19.55% upside potential from current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue