U.S. hedge funds have become net sellers of stocks associated with the so called “Trump trade,” according to a report from Morgan Stanley (MS).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The Wall Street investment bank says that hedge funds became net sellers of global equities over the past week, selling North American stocks as they assess what a second Donald Trump presidency will mean for the U.S. economy and markets.

Professional money managers had piled into stocks that might benefit from a second Trump presidency in the wake of the U.S. election on November 5. Hedge funds aggressively bought financial and industrial stocks on expectations that those securities would get a lift from deregulation and protectionist trade policies under a new Trump term.

Profit Taking?

But now, hedge funds appear to be abandoning the Trump trade and have become net sellers of U.S. equities, notably financial, industrial, and defense stocks, according to Morgan Stanley. Hedge funds also were net sellers of discretionary stocks such as hotels and restaurants, as well as healthcare stocks.

Some analysts say the selling by hedge funds could be the result of profit taking after big gains were made during the post-election rally. Others say hedge funds appear to be reassessing their portfolios as the reality of what a second Trump administration will mean for markets sinks in.

Morgan Stanley’s stock has risen 47% this year.

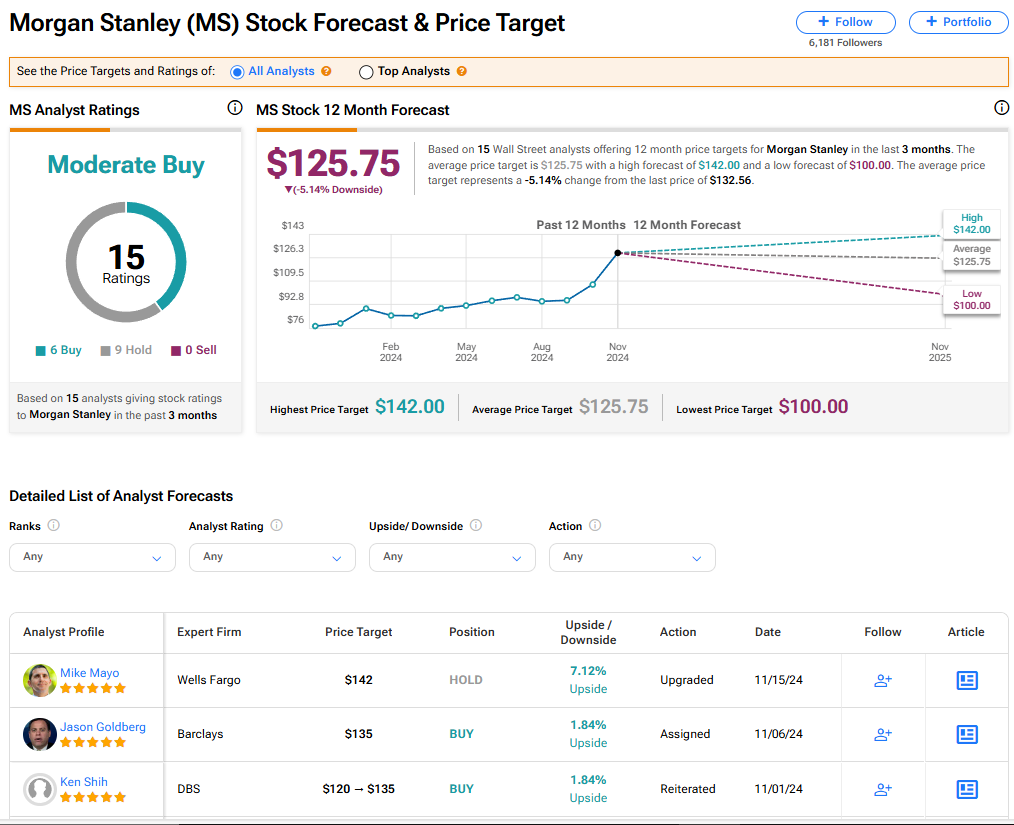

Is MS Stock a Buy?

Morgan Stanley stock has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on six Buy and nine Hold recommendations issued in the last three months. There are no Sell ratings on the stock. The average MS price target of $125.75 implies 5.14% downside risk from current levels.