Alphabet (NASDAQ:GOOGL) is at the forefront of the race to claim the spoils of the AI revolution, with tech giants pouring massive capital into the infrastructure essential to support this transformative technology. Eager to stay ahead of the competition, the tech giant has invested heavily in advancing its AI solutions while simultaneously focusing on cost-cutting measures for AI-assisted search queries.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Pivotal Research analyst Jeffrey Wlodarczak notes that Alphabet’s Q3 results offers evidence that the company is on track towards retaining its market prominence.

“GOOG appears to be in a very strong competitive position with a deep moat around their dominant core search business model,” writes the analyst, adding that the company controls some 90% of the global market (excluding China).

Alphabet’s Q3 numbers beat expectations across the board, including search, advertising, and Google Cloud. Wlodarczak finds Google Cloud’s impressive 35% growth particularly encouraging.

“GOOG also holds a strong #3 position in cloud computing, which as evidenced by the 3Q acceleration in revenue growth has dramatic growth potential given still relatively low (15-20%) cloud market share of enterprise workloads (+ benefits from AI),” Wlodarczak argues.

Looking ahead, Wlodarczak anticipates that personal AI assistants embedded within device ecosystems will likely be the next frontier for AI innovation.

“All else being equal this is great for AAPL and GOOG given their device dominance and GOOG should be able to extend (via payments) its default search dominance to default AI unless prohibited by governments,” Wlodarczak explained.

All in all, Wlodarczak rates GOOGL shares a Buy, while his $225 price target implies a 30% upside from current levels. (To watch Wlodarczak’s track record, click here)

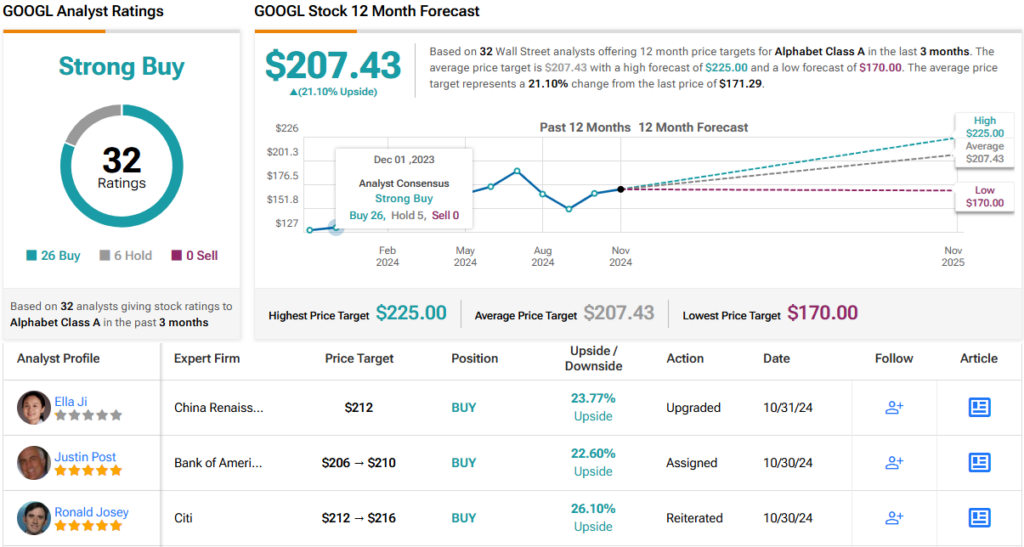

Wall Street largely echoes this positive outlook. Over the last three months, GOOGL has received 26 Buy recommendations and 6 Holds, resulting in a Strong Buy consensus. Its 12-month average price target of $207.43 implies an upside of 21%. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.