Monday.com (NASDAQ:MNDY) surged in pre-market trading after announcing better-than-expected Q1 results. The cloud-based platform reported adjusted earnings of $0.61 per diluted share in the first quarter, more than double its earnings per share in the same period last year. Analysts were expecting the company to report earnings of $0.40 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

MNDY generated Q1 revenue of $216.9 million, an increase of 34% year-over-year, exceeding consensus estimates of $210.5 million.

MNDY’s Key Business Highlights in Q1

The number of paid customers with more than $50,000 in annual recurring revenue (ARR) in the first quarter was 2,491, a 48% increase year-over-year. Additionally, the number of paid customers with more than $100,000 in ARR was 911, up by 55% year-over-year. During the first quarter, the company achieved a record free cash flow of $89.9 million.

Furthermore, the company’s management stated that its sales customer relationship management (CRM) platform and its developer (dev) platform experienced rapid growth in Q1, with “accelerating account additions.”

Monday.com’s Financial Outlook

In FY24, the company expects revenue between $942 million and $948 million, above Street estimates of $934.6 million. Adjusted operating income is likely to be in the range of $77 million to $83 million in FY24.

For Q2, MNDY has projected revenues between $226 million and $230 million, while adjusted operating income is anticipated to be in the range of $17 million to $21 million.

Is MNDY a Good Stock to Buy?

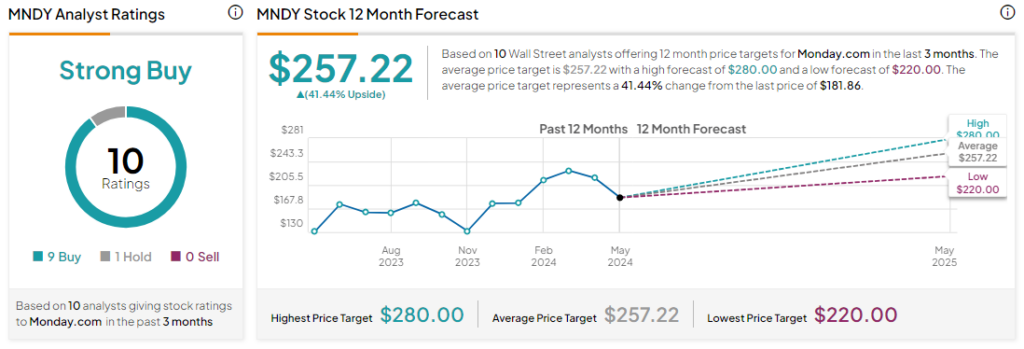

Analysts remain bullish about MNDY stock, with a Strong Buy consensus rating based on nine Buys and one Hold. Over the past year, MNDY has increased by more than 15%, and the average MNDY price target of $257.22 implies an upside potential of 41.4% from current levels. These analyst ratings are likely to change following monday.com’s Q1 results today.