MicroStrategy (MSTR) stock finished up today as the business intelligence and software provider prepares to report Q3 earnings on October 30, 2024. Analysts are expecting earnings per share to come in at -$0.12 on revenue of $121.45 million. This equates to 78.94% and 8.98% year-over-year increases, respectively, according to TipRanks’ data.

This is ideal, as earnings per share should grow at a faster rate than revenue. In addition, MSTR stock has surged 57% over the past three months, likely due primarily to the company’s significant Bitcoin (BTC-USD) assets. BTC prices are rising today, and they have been trending upward all week.

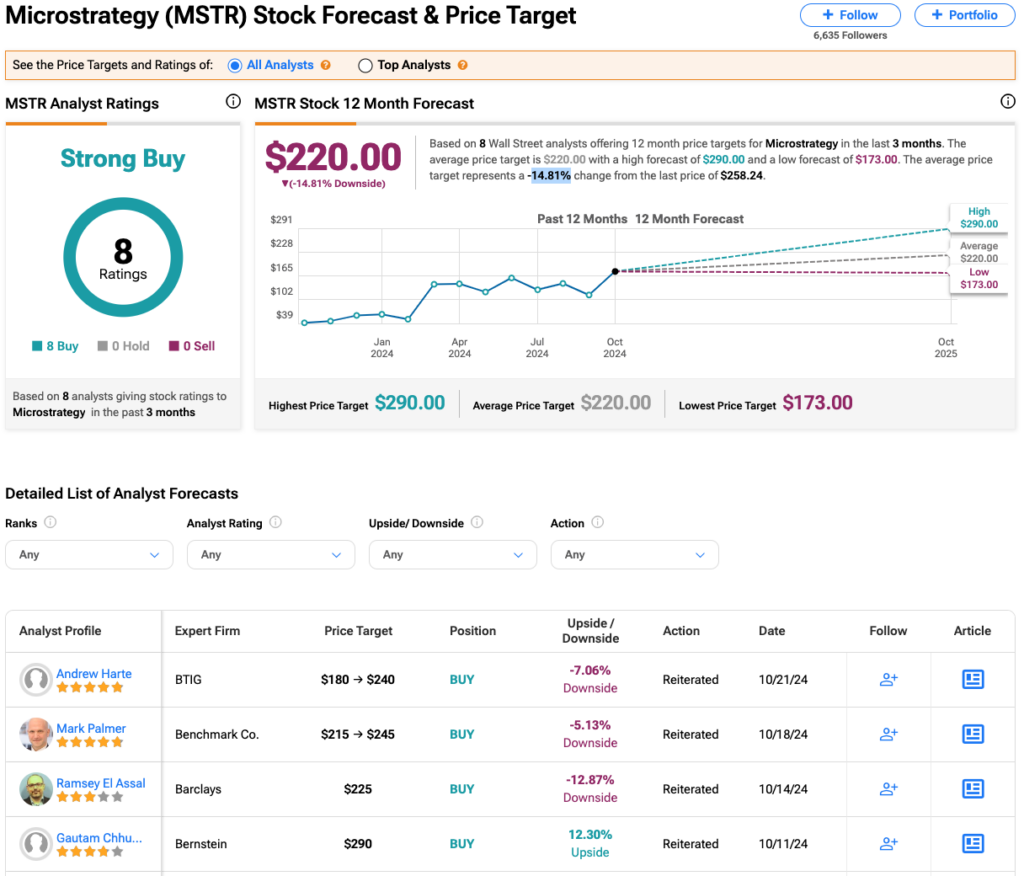

BTIG analyst Andrew Harte recently raised his MSTR stock price target from $180 to $240 while maintaining a Buy rating ahead of earnings. In a note to investors, he stated that “the market is [] rewarding the company for its capital raises since Q2 earnings, which were in part used to remove existing high interest-rate debt that some investors were concerned about in regard to interest coverage.”

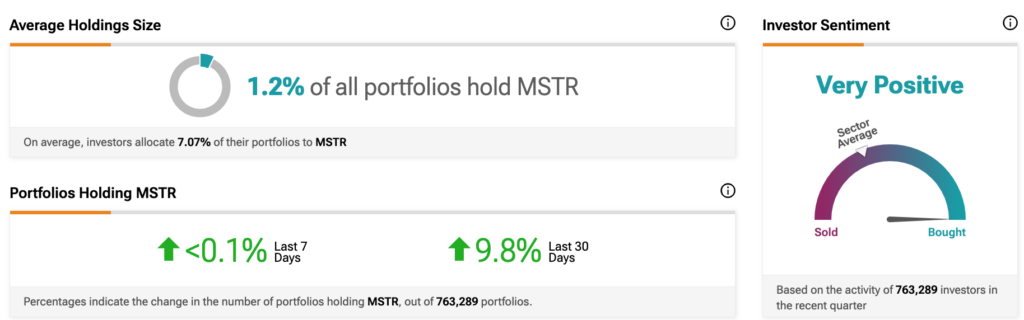

Investor Sentiment Is Currently Positive

Similar to Harte, many investors hold an extremely positive view of MSTR stock pre-earnings. Over the last 30 days, almost 10% of the portfolios holding MicroStrategy have increased their position. While that number has only increased 0.1% in the past week, investor sentiment toward MSTR remains Very Positive, as indicated by TipRanks data.

While only 1.2% of all portfolios hold the stock, the investors behind them have displayed an undeniably bullish outlook.

Is MicroStrategy Stock a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on eight Buys assigned in the past three months, as indicated by the graphic below. Nevertheless, after a 515% rally in its share price over the past year, the average MSTR price target of $220 per share implies 14.8% downside potential.