Microsoft (MSFT) is gearing up to release its Fiscal Q1 2025 earnings on October 30, with expectations already set quite high. As the tech giant leads in cloud computing, artificial intelligence (AI), and enterprise software, investors will be closely watching critical segments like Azure and Dynamics 365 for signs of continued growth. With ongoing innovation and expanding enterprise solutions, I believe Microsoft is well-positioned to meet their expectations. In the meantime, the stock’s valuation seems attractive, with Wall Street seeing enduring double-digit top and bottom-line growth for years to come. Accordingly, I continue to hold a bullish stance on MSFT stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Microsoft Azure’s Growth Trajectory and AI Integration

One of the most critical areas investors will likely focus on in Microsoft’s upcoming Fiscal Q1 report is the continued growth of Microsoft’s Azure cloud business, particularly in light of its AI-driven advancements in recent months. So far, Azure has been a key revenue driver for Microsoft, growing 29% in the previous quarter and contributing to the broader Intelligent Cloud segment’s 19% growth.

In my view, Microsoft is poised to deliver excellent results here once again. Management has consistently highlighted AI as key to expanding Azure’s potential, with significant investments in AI infrastructure and products like Azure OpenAI Service. Given these commitments and their solid track record, it’s reasonable to expect high ROI (return on investment) in these areas. Microsoft’s previous results back this up, and I anticipate that Q1 will follow suit. Note that by Fiscal Q4 2024, over 60,000 customers (up 60% year-over-year) were already utilizing Azure AI services, with rising customer spend, which also signals continued strong growth in this area.

Nevertheless, I expect that Wall Street will carefully watch for any signs of slowing growth and potentially punish the stock, assuming underwhelming results. This is especially true given the deceleration in some European markets in recent quarters. Analysts will also be looking for updates on Azure’s margins as the company scales AI capabilities, a factor that slightly compressed cloud margins in Q4. A margin expansion in this area would power the stock’s bullish sentiment.

The Dynamics 365 and Power Platform Momentum

Another area I believe will be of significant interest in Fiscal Q1 is the momentum of Microsoft’s Dynamics 365 and Power Platform segments. Dynamics 365, Microsoft’s CRM and ERP solution, saw revenues rise by 19% in the previous quarter, helping boost overall Dynamics revenue by 16%. Investors will, thus, be keen to see whether this momentum continues, particularly with Microsoft integrating AI-driven features like Copilot, which the company has been promoting heavily in recent tech conferences.

It’s also worth looking at Microsoft’s Power Platform. The average investor might not be familiar with this division, yet it includes critical offerings such as Power BI, Power Apps, and Power Automate. These tools have grown substantially, boasting over 48 million monthly active users. They benefit from businesses adopting low-code solutions integrated with AI, fueling a 40% growth in the platform over the past year. This aspect was highlighted by management during last month’s Citi Global TMT Conference. Notably, management believes this figure can be 10x long-term.

For this reason, I think that it’s worth keeping an eye on updates regarding customer adoption rates in Microsoft’s upcoming results and how these tools support enterprises in their AI transformation efforts, as this segment could become a substantial growth driver.

Should You Consider Microsoft Stock Before Its Q1 Results?

While there are compelling reasons to expect Microsoft to deliver strong results across key areas, should you consider the stock ahead of its Q1 results? I believe the answer is yes. Microsoft is currently trading at a fair valuation, and since it typically commands a premium, now could be an opportune time to initiate a position or add to your existing one.

Specifically, the stock trades at around 32 times this Fiscal year’s expected EPS. While this multiple doesn’t seem too humble, I believe it’s more than justified by Microsoft’s critical role in today’s tech infrastructure. The company is a leader in cloud computing, AI, enterprise software, and gaming, which are all expected to grow significantly in the coming years.

But don’t just take my word for it – consensus estimates for revenue and earnings per share (EPS) project sustained double-digit growth through at least 2031, with average rates in the mid-teens. These estimates highlight the significant tailwinds driving the company in the current environment. Along with Microsoft’s nearly indispensable role in today’s tech economy, I think Wall Street’s growth forecasts and the stock’s current valuation present a compelling investment case.

Is MSFT Stock a Buy, According to Analysts?

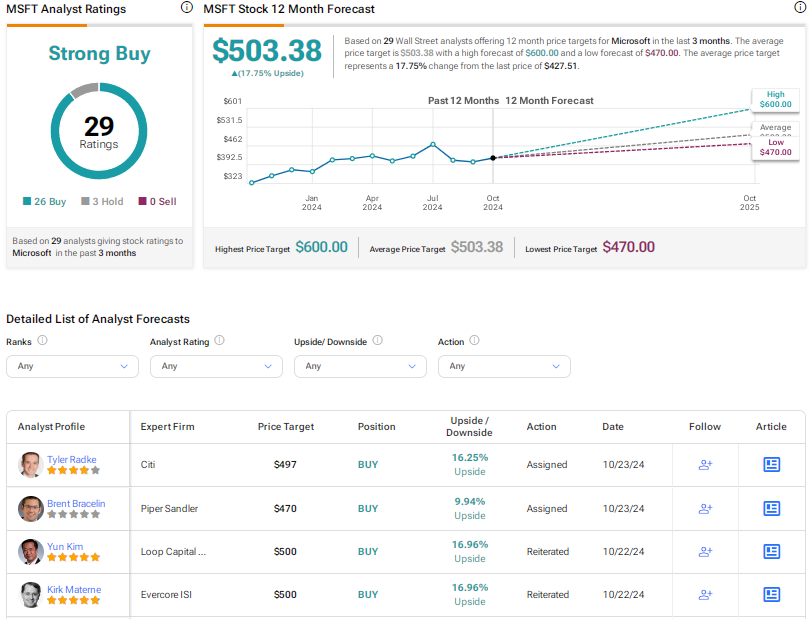

Peeking at Wall Street’s view on MSFT stock, we see a Strong Buy consensus rating based on 26 Buys and three Holds assigned in the past three months. At $503.38, the average MSFT stock forecast suggests a 17.75% upside potential.

If you’re unsure which analyst to trust for trading MSFT stock, consider Alex Zukin from Wolfe Research. According to Tipranks’ ratings, he is a five-star analyst. Over the past year, he has been the most accurate and most profitable analyst covering this stock, delivering an average return of 34.1% per rating with a 97% success rate.

Takeaway

Overall, I believe that Microsoft’s upcoming Fiscal Q1 2025 earnings report holds significant potential for positive momentum, particularly regarding its Azure and Dynamics 365 segments. With AI integrations continuously boosting cloud and enterprise solutions, Microsoft seems positioned to satisfy Wall Street’s expectations and sustain strong top and bottom-line growth.

While investors will look for pitfalls in the report, such as margin compression or regional slowdowns, I still think that Microsoft’s dominant role in cloud computing and AI offers long-term appeal, especially at today’s valuation.