Microsoft (MSFT) is partnering with Constellation Energy (CEG) in hopes of restarting a nuclear reactor at Three Mile Island and using the power it generates to fuel its artificial intelligence (AI) applications.

In a news release, Constellation Energy said that it hopes to get the Unit 1 nuclear reactor at Three Mile Island in Pennsylvania back online in 2028. That particular reactor has been shutdown since 2019 and getting it started again requires approval from the U.S. Nuclear Regulatory Commission. Three Mile Island was the site of a partial nuclear meltdown in 1979, which remains the worst nuclear accident in U.S. history.

Powering Data Centers and AI

Microsoft said that it plans to purchase the electricity that Constellation Energy generates from the Three Mile Island reactor and and use it to power its data centers and AI applications. Microsoft, and other technology companies, have said that they need greater sources of power to run generative AI systems and models that consume vast amounts of electricity.

While terms of the deal were not disclosed by the companies, Constellation Energy said its arrangement with Microsoft is its largest power purchase agreement ever. Constellation Energy’s stock has more than doubled this year as demand for the power it generates and sells skyrockets. CEG stock is up 14% today (Sept. 20) on news of its deal with Microsoft.

MSFT stock is down 0.74% today, though its share price has gained 17% year to date and currently trades at $435.43 a share.

Is MSFT Stock a Buy?

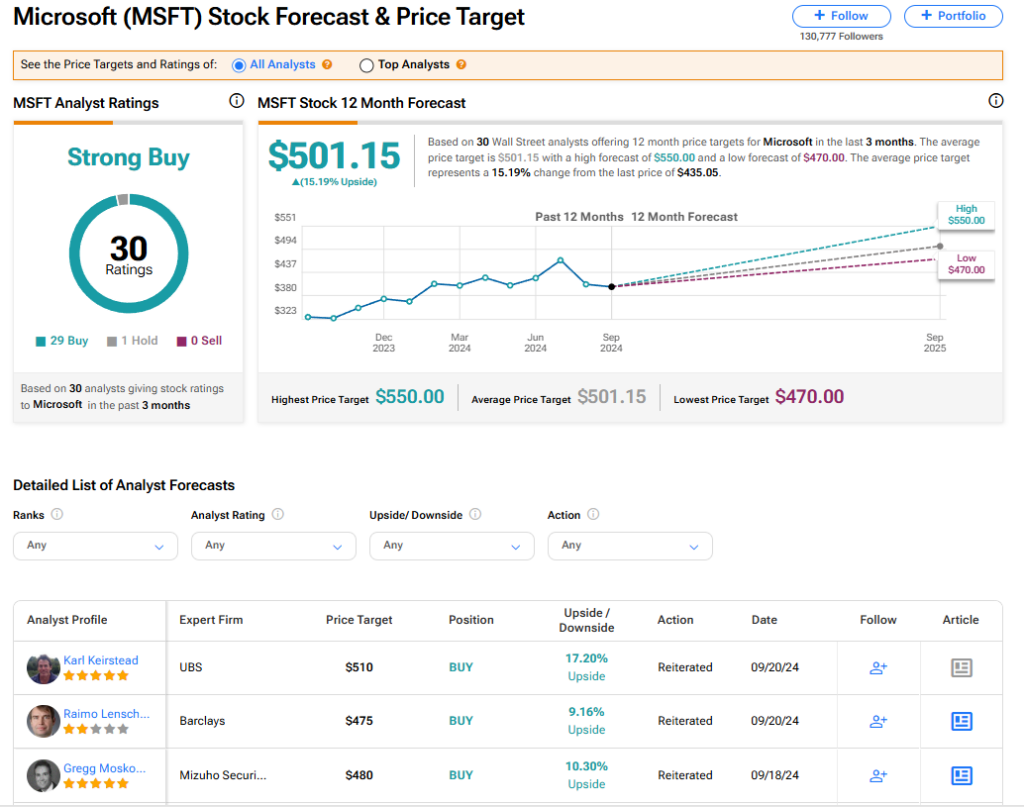

Microsoft’s stock currently has a consensus Strong Buy rating among 30 Wall Street analysts. That’s based on 29 Buy and one Hold recommendations made in the past three months. There are no Sell ratings on the stock. The average price target on MSFT stock of $501.15 implies 15.20% upside from current levels.