A Microsoft (MSFT) and Blackrock (BLK)-led group is launching a $100 billion AI (artificial intelligence) infrastructure fund to set up data centers. The group will pull up the initial $30 billion from investors, asset owners, and corporates, and plans to raise the remaining amount through debt financing. The fund is called the Global AI Infrastructure Investment Partnership (GAIIP).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The group includes other companies like Blackrock-acquired Global Infrastructure Partners (GIP) and UAE-based tech company MGX. Chipmaker Nvidia (NVDA) will act as an advisor to the group.

Microsoft, Blackrock’s Fund to Advance AI Innovation

The GAIIP’s mission is to advance AI innovation and grow AI applications across all industries. Generative AI models require massive computational power provided by data centers. The GAIIP will feature open architecture and a broad ecosystem that will give access on a non-exclusive basis to various partners and companies.

The GAIIP’s investments will majorly be focused in the U.S., with the remaining funds being invested in partner countries.

Microsoft Bets Big on AI

Tech giant Microsoft has emerged as a big player in AI, making significant investments in the domain. Microsoft is one of the major investors in ChatGPT-maker OpenAI. It is also expanding its own AI capabilities with Azure public cloud.

Microsoft spent $19 billion toward capital expenditures in the fourth quarter of Fiscal 2024. Furthermore, the company has hinted at spending even more toward cloud and AI segments in Fiscal 2025.

Is Microsoft a Good Stock to Buy Right Now?

Analysts are highly encouraged by Microsoft’s commitment to enhance shareholder value. Yesterday, MSFT hiked its quarterly dividend by 10% and announced a new $60 billion share buyback program, drawing analysts’ bullish comments.

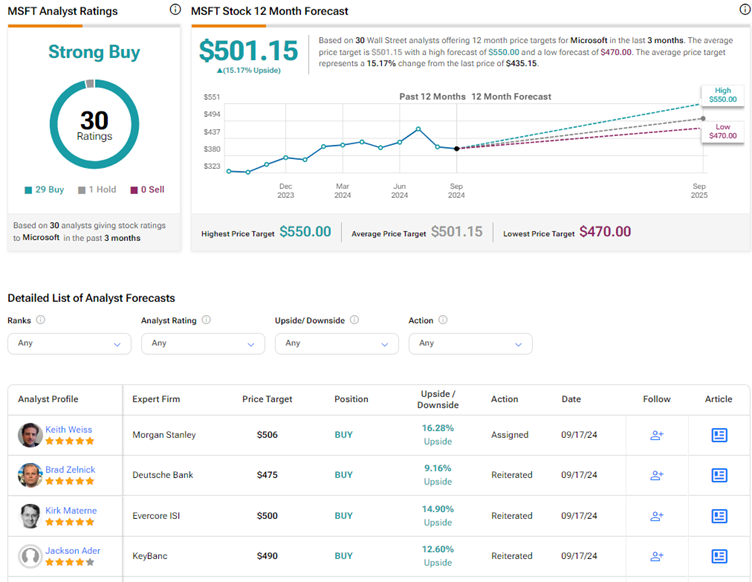

On TipRanks, MSFT stock commands a Strong Buy consensus rating based on 29 Buys and one Hold rating. The average Microsoft price target of $501.15 implies 15.2% upside potential from current levels. Year-to-date, MSFT shares have gained 16.4%.