Semiconductor company Micron Technology (MU) is scheduled to announce its results for the fourth quarter of Fiscal 2024 after the market closes on September 25. Wall Street expects the memory and storage solutions provider to deliver earnings per share (EPS) of $1.11 compared to the loss per share of $1.07 in the prior-year quarter.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This notable improvement in earnings is expected to be driven by a more than 90% year-over-year jump in revenue to $7.65 billion. Micron is expected to gain from artificial intelligence (AI)-led demand for its products.

It is worth noting that Micron has exceeded analysts’ earnings expectations in seven of the past nine quarters.

Analysts Weigh in on Micron’s Upcoming Results

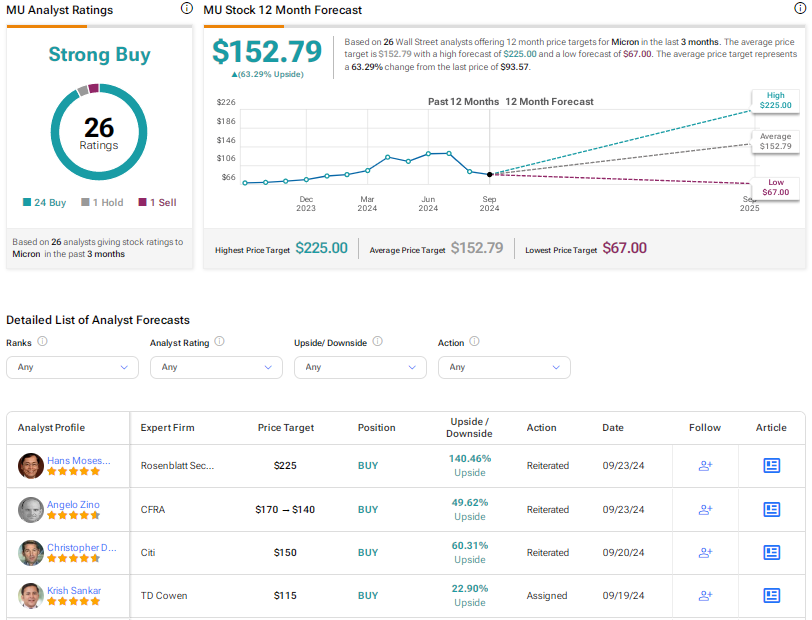

Ahead of the Q4 FY24 results, Rosenblatt analyst Hans Mosesmann reiterated a Buy rating on MU stock with a price target of $225. The analyst expects the company’s results to be in line with market expectations, driven by continued recovery in the memory market.

However, the analyst highlighted concerns related to mixed non-AI PC and smartphone residual inventory issues, which could lead to near-term pricing pressures. Accordingly, Mosesmann revised his FY25 estimates to reflect a two-quarter delay in the non-AI recovery. That said, he remains bullish on Micron’s AI story, which involves solid demand for its HBM (high-bandwidth memory) offerings and the accelerated compute memory cycle.

Meanwhile, CFRA analyst Angelo Zino slashed the price target for Micron stock to $140 from $170 while reiterating a Buy rating. The analyst noted that MU stock is down over 40% from peak levels seen this summer over concerns about memory demand, as customers have built up inventories in the PC and smartphone markets. Despite these headwinds, Zino remains optimistic about MU due to the growth tied to its HBM products, which are expected to boost revenue and profits.

Options Traders Expect a Notable Move

Using TipRanks’ Options tool, we can gauge options traders’ expectations for MU stock following the earnings report. Based on a strike price of $89, with call options priced at $7.10 and put options at $2.44, the expected price movement based on the at-the-money straddle is 9.82%.

Is Micron Stock a Good Buy?

Despite near-term concerns, most analysts remain bullish on MU stock. With 24 Buys, one Hold, and one Sell recommendation, Micron stock earns a Strong Buy consensus rating on TipRanks. The average MU stock price target of $152.79 implies 63.3% upside potential from current levels. Shares have risen about 10% year-to-date.