Michael Burry, a hedge fund manager who became famous thanks to his “Big Short” against the housing bubble in 2008, revealed his recent moves in a 13F filing. His hedge fund, Scion Asset Management, increased its stake in Chinese tech giants Alibaba (BABA), Baidu (BIDU), and JD.com (JD) as follows:

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- BABA shares increased from 155,000 to 200,000

- BIDU shares increased from 75,000 to 125,000

- JD shares increased from 250,000 to 500,000

Interestingly, he also added put options to his Chinese holdings as a hedge against any share price declines. For BABA, he has the equivalent of 168,900 shares short through options contracts, while his BIDU and JD positions have the equivalent of 83,800 and 500,000 shares short, respectively.

On the other hand, Scion reduced its stakes in American Coastal Insurance (ACIC) to 100,000 shares from 251,892 and in The RealReal (REAL) to 500,000 shares from 1 million. The fund also exited its positions in BioAtla (BCAB) and Hudson Pacific Properties (HPP).

What Is the Best Chinese Stock to Buy?

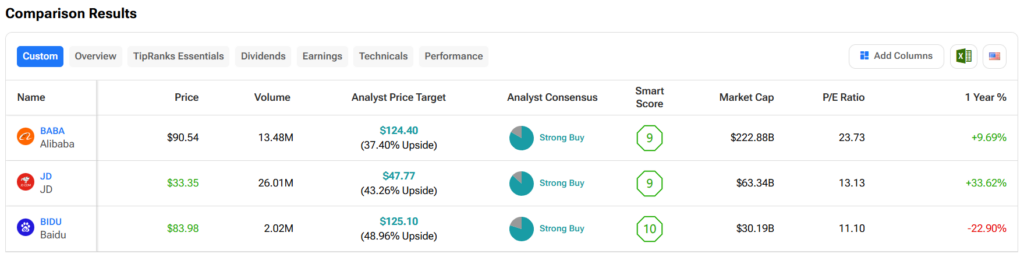

Turning to Wall Street, out of the three Chinese stocks mentioned above, analysts think that BIDU stock has more room to run. In fact, BIDU’s price target of $125.10 per share implies almost 49% upside versus BABA’s 37.4% and JD’s 43.3%.