MGM Resorts International (MGM) delivered strong second-quarter results, with revenue and earnings surpassing expectations, driven by a significant boost from its Macau operations. Despite this upbeat performance, MGM stock declined 3.7% in yesterday’s extended trading session. The drop can be attributed to weaker-than-expected bookings for the upcoming Formula 1 race scheduled for November 23 in Las Vegas, signaling lower demand.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

MGM is a global hospitality and entertainment company known for its resorts, casinos, and entertainment offerings.

MGM: Q2 Snapshot

The company reported adjusted earnings of $0.86 per share, which increased 45.8% year-over-year and surpassed the consensus estimate of $0.6. Furthermore, the company’s revenue grew 9.8% year-over-year to $4.33 billion and beat the analysts’ expectations of $4.21 billion.

The top-line growth was driven by the recovery at MGM China, which witnessed a 33% jump in casino revenue. Importantly, the removal of COVID-19 restrictions in Macau earlier this year has fueled a rebound in gaming activity. MGM China is a subsidiary of MGM Resorts International, operating casinos and resorts in China, specifically in Macau.

Further, continued strength in Las Vegas also aided results. Revenue per available room increased to $240 from $224 in the prior year quarter, driven by a higher occupancy rate of 97%.

MGM’s Future Performance

Despite the success of last year’s inaugural Formula 1 race in Las Vegas, bookings for this year’s event have been softer than expected. MGM disclosed a decline in average daily rates (ADRs), indicating weaker demand compared to the previous year.

Nevertheless, MGM CEO William Hornbuckle remains optimistic about the company’s progress, highlighting the expansion of its digital offerings.

Furthermore, the recovery in Macau and positive momentum in Las Vegas keep the company well-positioned for continued growth.

Is MGM a Buy or Sell?

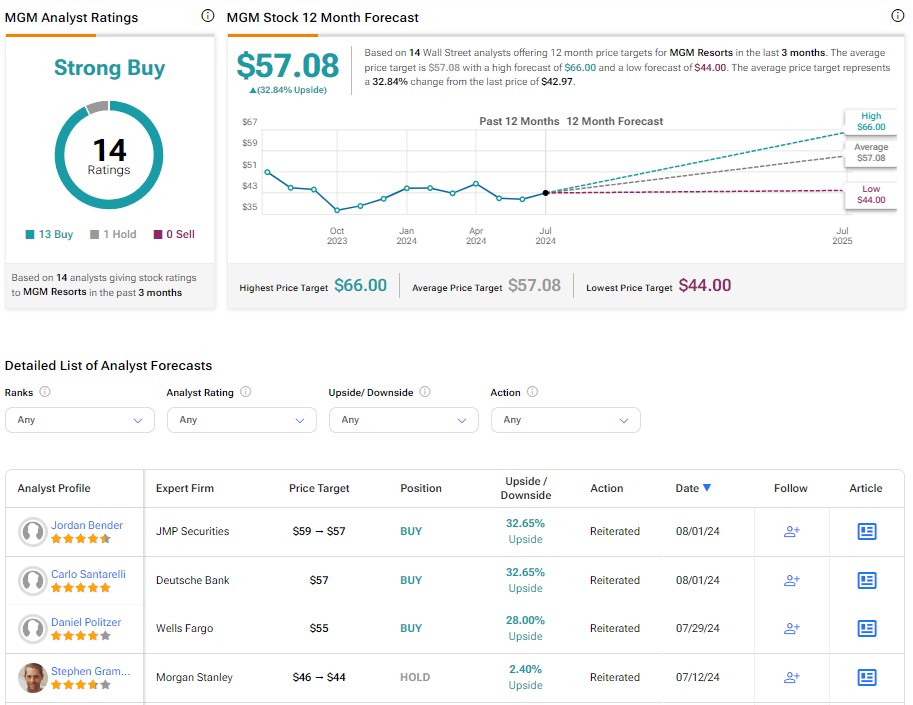

Overall, Wall Street is optimistic about the stock. It has a Strong Buy consensus rating based on 13 Buys and one Hold. The analysts’ average price target on MGM Resorts stock is $57.08, implying a 32.84% upside potential from current levels. Year-to-date, the stock is down 3.8%.

It’s important to note that analysts’ perspectives on MGM may change following the upbeat Q2 earnings report.