Mondelez International (MDLZ) surpassed both sales and earnings estimates for the third quarter of Fiscal 2024. The news pushed MDLZ shares up 3.4% briefly in Tuesday’s extended trading before ending flat. Adjusted earnings of $0.99 per share handily beat the consensus of $0.85 per share. Also, revenue of $9.20 billion exceeded the analysts’ expectations of $9.11 billion. In the prior-year period, Mondelez posted adjusted earnings of $0.77 per share on revenue of $9.03 billion.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The global snacking giant has exceeded estimates in all the past eight quarters, reflecting its strong market presence and growing demand for its offerings. Having said that, the persistently high cocoa price remains a drag on Mondelez’s performance. Mondelez is home to several renowned chocolate brands, including Cadbury and Toblerone.

Factors Contributing to Mondelez’s Q3 Performance

Mondelez’s Q3 organic revenue grew 5.4% year-over-year, thanks to a favorable volume/mix and pricing efficiencies. For Fiscal 2024, the company guided for an organic revenue growth rate at the high end of the 3% to 5% range, while adjusted earnings per share is expected to grow by high single-digits over FY23. For the full year, free cash flow is projected at over $3.5 billion.

Analysts’ Initial Views on Mondelez’s Q3 Print

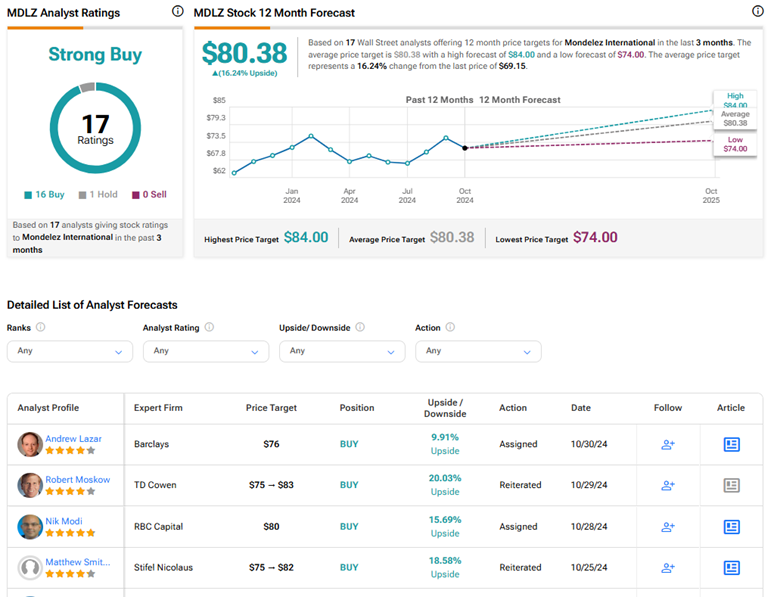

Jefferies analyst Robert Dickerson lowered the price target on MDLZ stock to $80 (15.7% upside potential) from $84 due to continued cocoa price pressure on earnings. Even so, the analyst remains a Buy on the stock owing to the company’s strong fundamentals and balance sheet, distribution opportunities in emerging markets, and attractive end-market segment exposure.

Also, TD Cowen analyst Robert Moskow kept a Buy rating and $83 price target (20% upside) on Mondelez stock, following the Q3 print. Although Mondelez reported better-than-expected results, Moskow remains concerned about the elevated cocoa prices.

Is MDLZ a Good Stock to Buy?

Despite the cocoa headwinds, analysts remain highly optimistic about Mondelez’s stock trajectory owing to its strong market position. On TipRanks, MDLZ stock has a Strong Buy consensus rating based on 16 Buys versus one Hold rating. The average Mondelez International price target of $80.38 implies 16.2% upside potential from current levels. Year-to-date, MDLZ shares have lost 2.7%.

Please note these ratings could change after analysts review Mondelez’s latest results.