Shares of MongoDB (MDB) surged in after-hours trading after the software company reported earnings for its second quarter of Fiscal Year 2025. Earnings per share came in at $0.70, which beat analysts’ consensus estimate of $0.49 per share. In addition, sales increased by 12.8% year-over-year, with revenue hitting $478.1 million. This beat analysts’ expectations by $13.9 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The guidance also thrilled investors. In fact, management now expects revenue and adjusted earnings per share for Q3 2025 to be in the ranges of $493 million to $497 million and $0.65 to $0.68, respectively. For reference, analysts were expecting $478.5 million in revenue, along with an adjusted EPS of $0.61.

Today’s results and subsequent surge come after money managers spent most of the last quarter selling the stock. In fact, hedge funds decreased their holdings in MDB stock by 155,400 shares in the past quarter. As a result, they have a very negative confidence signal, as indicated by the graphic below. It will be interesting to see if that sentiment changes going forward.

Is MDB Stock a Buy?

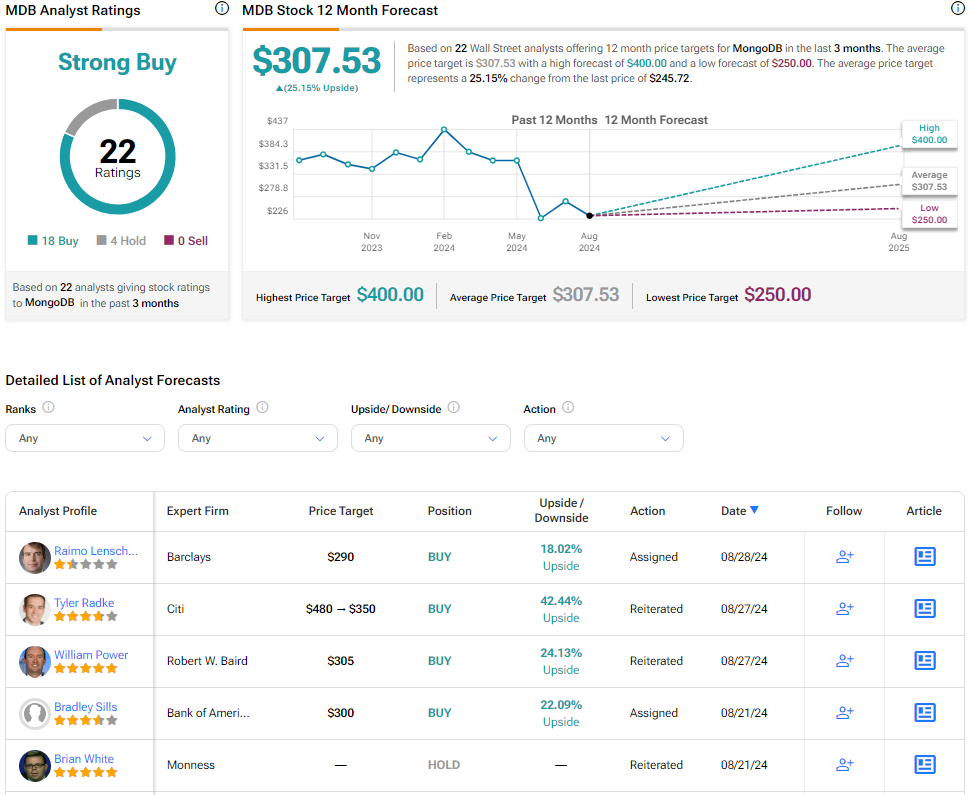

Turning to Wall Street, analysts have a Strong Buy consensus rating on MDB stock based on 18 Buys, four Holds, and zero Sells assigned in the past three months. Furthermore, the average MDB price target is $307.53 per share, which implies an upside potential of 25.15% after a 40% year-to-date decline.