Earlier today, Canadian digital health company WELL Health Technologies (TSE:WELL) announced a partnership with MCI Onehealth Technologies (TSE:DRDR), a Toronto-based healthcare tech firm, which is expected to “better position” MCI in the growing disease detection market, according to the press release. The alliance includes WELL taking ownership of clinical assets from MCI, a move forecasted to add over C$21 million in annual revenue and yield positive EBITDA by 2024.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

This announcement caused DRDR stock to finish more than 33% higher today. Meanwhile, WELL Health stock closed about 3.2% lower.

WELL’s investment in MCI is specifically targeted at bolstering MCI’s AI, Data Science, and Rare & Complex Disease Detection platform. Also, by taking in more than 130 physicians from MCI, WELL is accelerating its nationwide clinic expansion strategy.

The deal is expected to close by October 1, 2023, at which point WELL will secure a place on MCI’s board of directors and could potentially acquire up to 30.8 million Class A and B shares in MCI Onehealth over time.

Is WELL Health Stock a Buy, According to Analysts?

According to analysts, WELL Health earns a Strong Buy consensus rating based on nine unanimous Buy ratings assigned in the past three months. The average WELL Health stock price target of C$8.45 implies 85.7% upside potential.

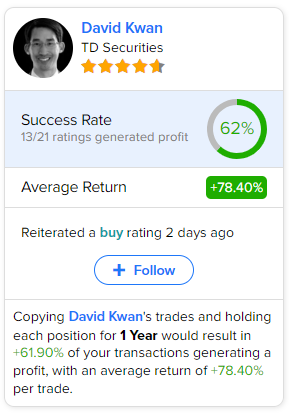

If you’re wondering which analyst you should follow if you want to buy and sell WELL stock, the most accurate analyst covering the stock (on a one-year timeframe) is David Kwan of TD Securities, with an average return of 78.4% per rating and a 62% success rate. Click the image below to learn more.