Energy prices saw a dramatic surge in 2022 due to increasing demand following the cessation of COVID-related shutdowns and emerging supply constraints. However, since then, they have also dropped considerably, taking energy stocks down. Despite this, the oil industry remains in a strong position, as the cost of production is still lower than the market price of crude oil, especially for well-managed drilling companies such as Matador Resources (MTDR), which keeps exceeding expectations.

MTDR operates in the upstream sector of the oil and gas industry and specializes in the exploration, development, and acquisition of oil and natural gas resources in the United States. Matador has exceeded quarterly earnings expectations for the past four quarters, helping to drive the stock up 15% over the past year. However, it trades at a discount to industry peers, making it an attractive option in the energy sector.

Matador Is Expanding its Delaware Basin Footprint

Matador is an independent energy firm that pursues, develops, produces, and procures oil and gas resources in the U.S. Its operations revolve around the Wolfcamp and Bone Spring plays in the Delaware Basin, prioritizing unconventional shale plays in New Mexico, West and South Texas, and the Haynesville shale and Cotton Valley plays in Northwest Louisiana.

The company is gearing up to complete its largest acquisition to date – the purchase of Ameredev for $1.905 billion. This acquisition is due for completion towards the end of Q3 2024. It is set to enhance Matador’s operations and position in the core of the northern Delaware Basin to 191,900 net acres and enrich its existing 10 to 15 years’ worth of high-quality inventory. This move is anticipated to provide consistent and profitable growth and increase its proven reserves to over 600 million barrels of oil and natural gas equivalent (BOE).

A notable part of the acquisition package is a 19% equity interest in Piñon Midstream. Post-acquisition, Matador’s operation team plans to implement operational efficiencies such as ‘simul-frac’ and ‘trimul-frac’ completion operations and dual fuel technologies on the newly acquired properties.

Matador’s Financial Results & Outlook

For the second quarter of 2024, Matador posted another quarter of results that exceeded expectations. Reported revenue of $847.14 million outperformed estimates of $826.41 million. The company documented a record daily average production of 160,305 BOE, including 95,488 barrels of oil, which were 2% and 3% higher than projected. Adjusted net income of $255.9 million, equivalent to an adjusted EBITDA of $58.0 million, and earnings per share (EPS) of $2.05, which surpassed consensus projections of $1.76.

The Board of Directors announced a quarterly cash dividend of $0.20 per common stock share, equivalent to a dividend yield of 1.15%. This dividend will be payable to shareholders officially on record as of August 15, 2024, and paid on September 5, 2024.

Management announced an increase in its full-year guidance range for 2024. The new guidance projects a 3.2% increase in total production, a 2.2% rise in oil production, and a 4.8% growth in natural gas production. Notably, these figures do not account for any expected production from Matador’s imminent acquisition of a subsidiary of Ameredev.

What Is the Price Target for MTDR Stock?

The stock has enjoyed an extended upward trend, climbing over 290% in the past five years. It trades near the middle of its 52-week price range of $51.72 – $71.08 and shows positive price momentum trading over the 50-day (61.30) and 100-day (61.33) moving averages. With a P/E ratio of 7.92x, shares trade at a relative discount to industry peers, with the Oil & Gas Exploration & Production industry average at 11.30x.

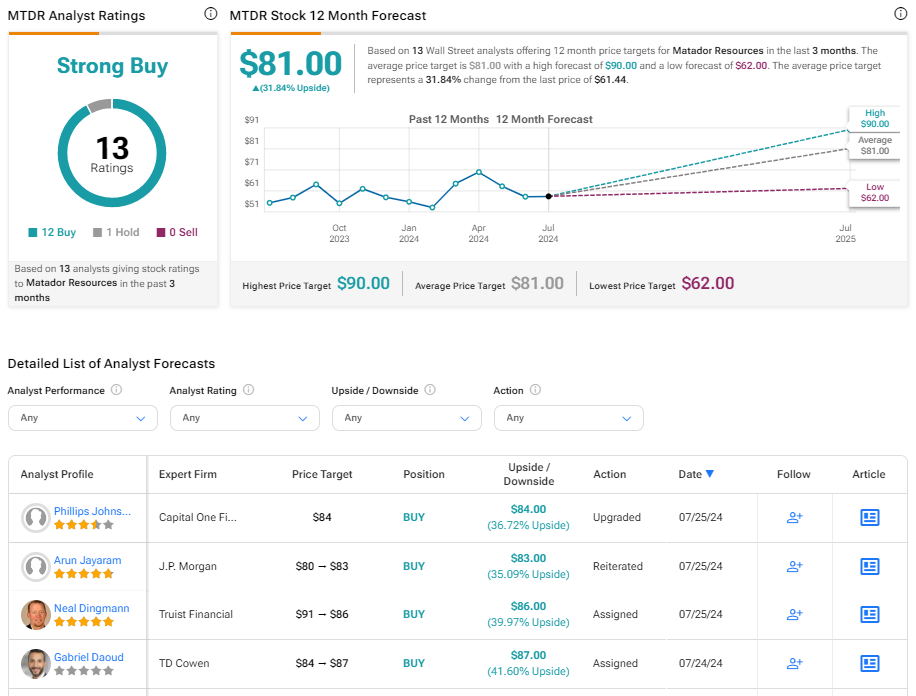

Analysts following the company have been bullish on the stock. For instance, Stephens analyst Michael Scialla recently initiated coverage on the shares with an Overweight rating and $83 price target, noting the firm offers investors differentiated organic growth in the sector.

Matador Resources is rated a Strong Buy overall, based on the recommendations and price targets assigned by 13 analysts. The average price target for MTDR stock is $81.00, representing a potential upside of 31.84% from current levels.

Bottom Line on MTDR

Matador has positioned itself as a solid contender in the oil and gas industry. Its strategic focus on unconventional shale plays and its impending acquisition of Ameredev are set to expand its growth and maximize its resource inventory. Matador has consistently surpassed earnings expectations and has offered an optimistic outlook for the rest of the year. MTDR continues to trade at a relative discount compared to industry counterparts, making it an attractive value-oriented investment opportunity in the energy sector.