Credit card giant Mastercard (MA) is pushing deeper into cryptocurrencies, saying it is focused on developing “real world solutions” for consumers.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Mastercard’s head of cryptocurrencies and blockchain technologies, Raj Dhamodharan, said in a recent interview with CoinDesk that the credit card issuer is moving beyond the experimentation phase when it comes to Bitcoin (BTC) and other digital assets.

Dhamodharan said that Mastercard now enables stablecoin payments for financial institutions, reflecting a growing trend in crypto adoption worldwide. Last week, the payments company announced a partnership with crypto compliance firm Notabene, which will integrate Mastercard’s Crypto Credential into its SafeTransact platform to make digital asset transactions more secure and easier to use.

A Bridge for Digital Payments

The Crypto Credential system is a focus of Mastercard’s overall crypto strategy. It allows users to send funds using familiar identifiers like email addresses rather than digital wallets. The system also helps prevent misdirected transactions by verifying whether a recipient’s digital wallet can receive an asset.

Dhamodharan said that Mastercard’s goal is to be a bridge between traditional finance and blockchain networks. The company plans to announce additional partnerships and use cases for crypto throughout 2025, reinforcing its commitment to integrating digital assets into global payment systems.

MA stock has risen 26% in the last 12 months.

Is MA Stock a Buy?

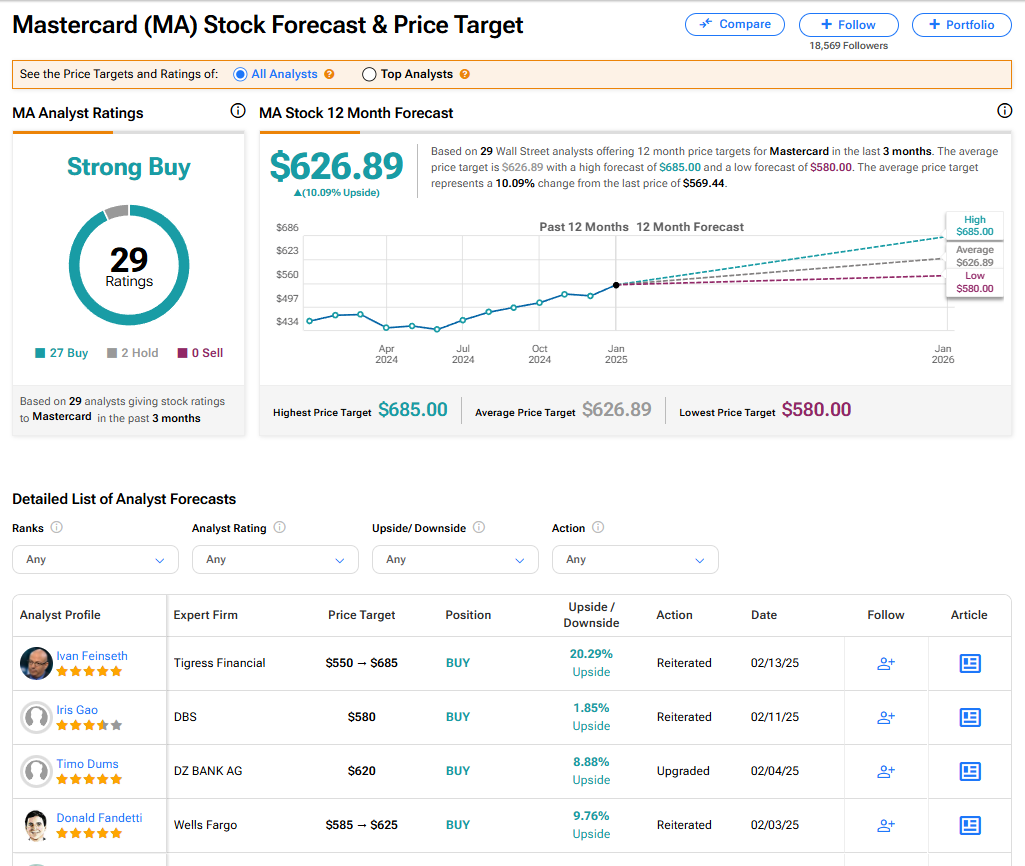

Mastercard’s stock has a consensus Strong Buy rating among 29 Wall Street analysts. That rating is based on 27 Buy and two Hold recommendations issued in the last three months. The average MA price target of $626.89 implies 10.09% upside from current levels.