Hospitality major Marriott International, Inc. (NASDAQ: MAR) recently announced that it has entered into an agreement with Baraka Lodges LTD to open its first luxury lodge in the Mara National Reserve of Africa. JW Marriott Masai Mara Lodge is expected to be operational by 2023. The company has an existing portfolio of 120 properties in Africa.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, shares of the company rose marginally to close at $170.95 in Tuesday’s extended trading session.

The lodge will be located on the banks of the River Talek, offering its guests an opportunity to be one with Masai Mara National Reserve’s breathtaking vistas, abundant wildlife and endless plains. Further, the lodge is expected to accommodate 20 private tents with all modern amenities.

The company expects to employ about 50 people from the local community and train them to offer their guests an enriching experience.

Management Commentary

The Vice-President of Marriott International, Bruce Rohr, said, “JW Marriott Masai Mara Lodge will offer guests a luxurious backdrop to make once-in-a-lifetime memories as they connect with nature and wildlife as never before. We are thrilled that the JW Marriott brand will be welcoming adventure travellers, including families, to this breath-taking part of the world.”

Stock Rating

Consensus among analysts is a Hold based on three Buys and nine Holds. The average Marriott International price target of $177.36 implies upside potential of 4% from current levels. Shares have gained 19.8% over the past year.

Website Traffic

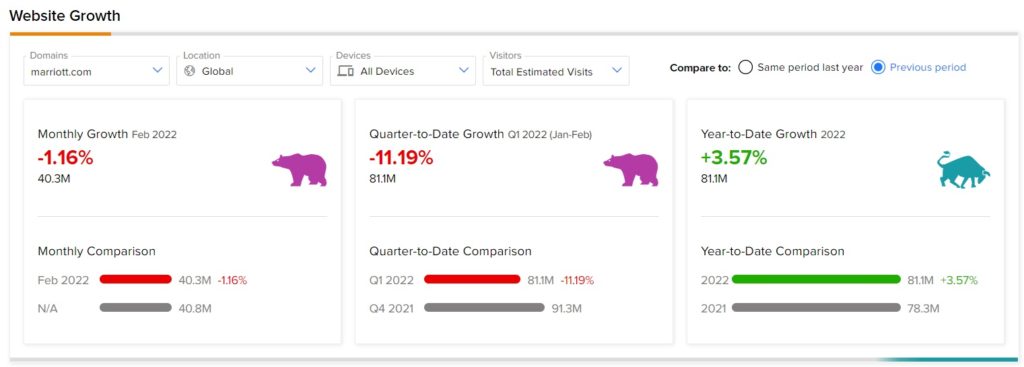

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Marriott International’s performance this quarter.

According to the tool, the Marriott International website recorded a 1.16% monthly decline in global visits in February, compared to the same period last year. Further, the footfall on the company’s website has increased 3.57% year-to-date, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Akerna Tanks 11.4% on Wider-Than-Expected Q4 Loss

Qualcomm Set to Invest $100M in the Metaverse Through a Venture Fund

Nokia Extends Partnership with T-Mobile Polska