The major U.S. indices closed lower on the day after the U.S. Federal Reserve delivered a 50-basis point interest rate cut and signaled that further easing of monetary policy is likely in coming months.

After initially rising on news of the central bank’s rate reduction, markets turned southward and closed in the red. The benchmark S&P 500 index finished trading down 0.62%, while the tech-laden Nasdaq Composite index fell 0.31% and the blue-chip Dow Jones Industrial Average closed down 0.25% having given up 375 points earlier in the trading session.

A Wild Trading Session

It was a wild day on the markets as stocks swung from gains to losses. Markets moved as the Federal Reserve not only cut interest rates but provided new forward guidance. The central bank projected that it will lower interest rates by another 50-basis points during the course of its two remaining policy meetings this year.

The so-called “dot plot” forecast indicated that the Federal Reserve expects the benchmark Fed Funds Rate to be in a target range of 4.25% to 4.50% by the end of 2024. The Fed’s two remaining interest rate decisions for the year are scheduled for November 7 and December 18. The central bank also forecasts that interest rates will decline another full percentage point in 2025 and by 50-basis points in 2026.

Is SPY a Buy Right Now?

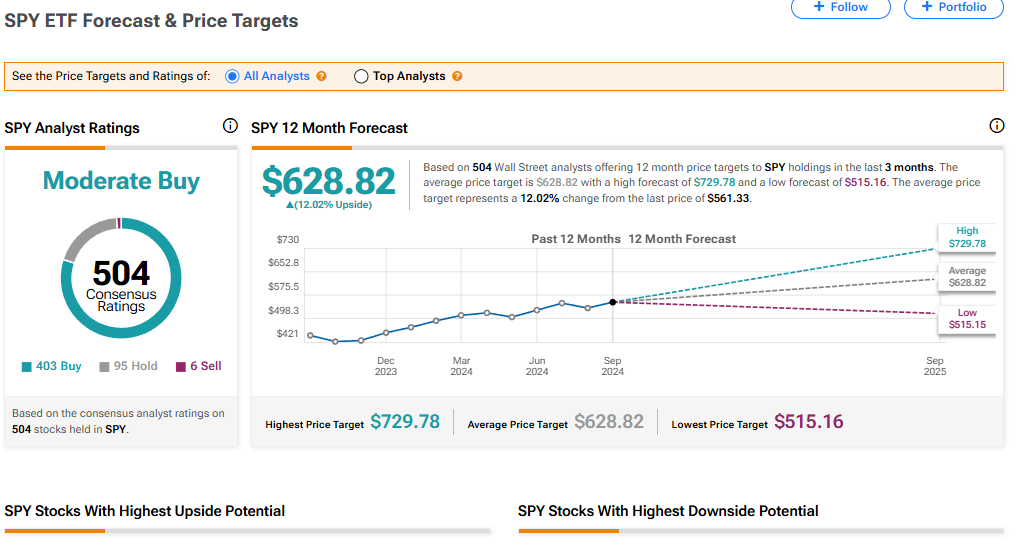

Turning to Wall Street, analysts have a Moderate Buy consensus rating on the SPDR S&P 500 ETF Trust based on 403 Buys, 95 Holds, and six Sells assigned in the last three months. After a 19% year-to-date rally, the average SPY price target of $628.82 per share implies 11.67% upside potential moving forward.

See the S&P 500 stocks with the most upside/downside potential