U.S. equities rallied on October 4, with the Dow Jones Industrial Average closing at a record high following a blockbuster labor report that showed underlying strength in the American economy.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The Dow, an index of 30 blue-chip stocks that serves as a proxy for the U.S. economy, rose 341.16 points, or 0.81%, to close an all-time high of 42,352.75. The broader S&P 500 index that serves as a benchmark for the U.S. stock market rose 0.9%, and the technology-laden Nasdaq Composite index gained 1.22%.

The rally ended what had been a gloomy start to October and was sparked by employment data that showed nonfarm payrolls across the U.S. grew by 254,000 jobs in September, far better than the 150,000 consensus forecast of economists. The U.S. unemployment rate is now at 4.1%.

Technology and Bank Stocks Rally

Stocks of major technology companies were among the big winners in the rally. Electric vehicle maker Tesla (TSLA), ecommerce giant Amazon (AMZN), and streaming service Netflix (NFLX) each saw their share prices rise more than 2% on the day. Financial stocks were another outperformer, rising 1.6% as a group. Shares of top banks JPMorgan Chase (JPM) and Wells Fargo (WFC) each rose more than 3%.

Small cap stocks also joined in the rally, with the Russell 2000 index of securities with small market capitalizations increasing 1% during the trading session. Cryptocurrencies rose, with Bitcoin (BTC) gaining 2% to trade at $62,250. Crude oil also continues to rise, bringing its weekly gain to 9%. Oil prices have been pushed higher by the escalating conflict in the Middle East.

Energy stocks notched their biggest weekly gain in almost two years having increased 7% since Sept. 30.

Is the SPY ETF a Buy?

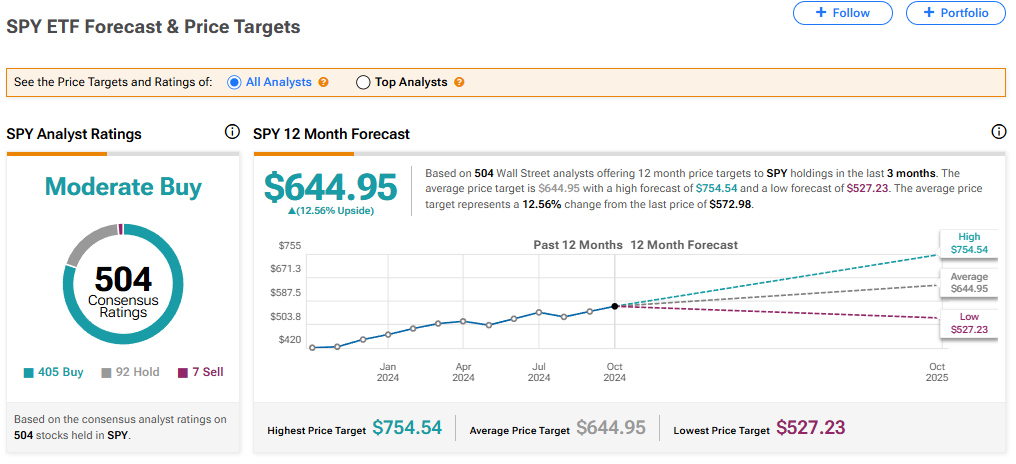

The SPDR S&P 500 ETF Trust (SPY) that tracks the benchmark S&P 500 index has a consensus Moderate Buy rating among 504 Wall Street analysts. That rating is based on 405 Buy, 92 Hold and seven Sell recommendations made in the last three months. The average SPY price target of $644.95 implies 12.56% upside potential from current levels.