The global market capitalization of cryptocurrencies has reached a record $3.2 trillion in the week since Donald Trump won the U.S. presidential election.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The record market cap comes as investors pile into crypto on rising expectations that a new Trump administration will lead to less regulation and wider adoption of digital coins and tokens. Bitcoin (BTC), the largest cryptocurrency by market capitalization, has risen more than 30% in the past week.

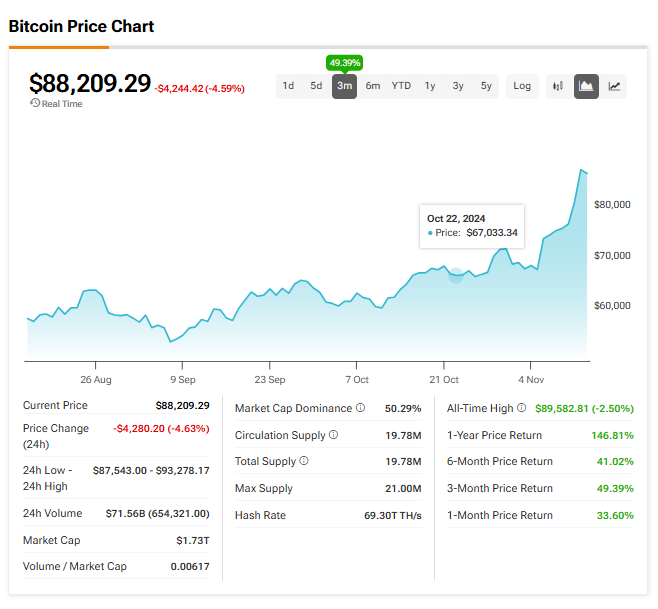

Bitcoin is currently trading near an all-time high of just over $92,000. In mid-October, Bitcoin was trading at $60,000. Other cryptocurrencies are also rallying, with Ethereum’s (ETH) price rising above $3,000. Meme coins have skyrocketed in recent days, with Dogecoin (DOGE) up almost 250% in the past month.

Institutional Investors are Bullish on Crypto

The record levels for crypto come as a new survey shows that more than half (57%) of institutional investors plan to increase their holdings of cryptocurrencies in the coming year. The annual survey by digital asset banking group Sygnum also found that 65% of respondents are bullish long-term on crypto, and 69% expect more favorable regulations under a second Trump presidency.

The survey gathers insights from more than 400 institutional and professional investors across 27 countries. The conclusion of the survey is that institutional investors remain bullish on crypto, fueled by a growing willingness to take risks and long-term confidence in digital assets.

Is BTC a Buy?

Most Wall Street firms do not provide forecasts for cryptocurrencies such as Bitcoin. So instead we look at the performance of BTC over the past three months. As one can see in the chart below, Bitcoin’s price has risen nearly 50% in the last 12 weeks, which is an extremely strong performance.