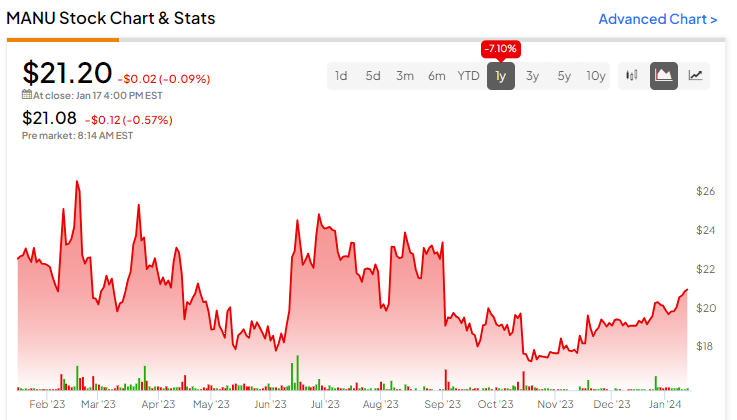

Shares of Manchester United (NYSE:MANU) are tanking today after the English Premier League football club announced its results for the first quarter and lowered its financial outlook.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, revenue increased by 9.3% year-over-year to £157.1 million. Net loss declined to £25.8 million from £26.5 million a year ago. The quarter was marked by double-digit gains in Broadcasting and Matchday revenue. Commercial revenue, the largest contributor to MANU’s top line, increased 3.4% to £90.4 million. However, operating expenses rose by 12.8% to £184.7 million.

Due to its early exit from the Champions League and the associated decline in Broadcasting revenue, MANU has scaled back its financial expectations for Fiscal Year 2024. Revenue for the year is anticipated to be between £635 million and £665 million versus the prior estimated range of £650 million to £689 million. Adjusted EBITDA during this period is seen hovering between £125 million and £150 million compared to the earlier guidance range of £140 million to £165 million.

What is the Price Target for MANU?

MANU shares have gained by nearly 9% over the past month after British billionaire Jim Ratcliffe picked up a 25% stake in the club for $1.3 billion. While analyst coverage on the stock remains sparse, an enterprise value-to-gross profit ratio of 6.41 indicates MANU stock may be hovering on the slightly expensive side.

Read full Disclosure