Wynn Resorts (WYNN) is an American multinational owner and operator of luxury hotels and casinos. The Nevada-based company was founded in 2002.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, Wynn Resorts reported a 53.5% year-over-year rise in revenue to $1.05 billion and surpassed the consensus estimate of $994 million. It posted a loss per share of $1.54, which narrowed from a loss per share of $2.53 in Q4 2020 but missed the consensus estimate of a $1.25 loss per share. The company ended the quarter with cash and cash equivalents of more than $2.5 billion.

Wynn Resorts recently announced a plan to sell the real-estate property of its Encore Boston Harbor unit to Realty Income (O). The transaction values the assets at $1.7 billion. At the same time, Wynn Resorts entered into a sale-leaseback agreement with Realty Income to allow it to continue using the properties for at least the next 30 years. The transaction is expected to be completed in Q4 2022.

With this in mind, we used TipRanks to take a look at the risk factors for Wynn Resorts.

Risk Factors

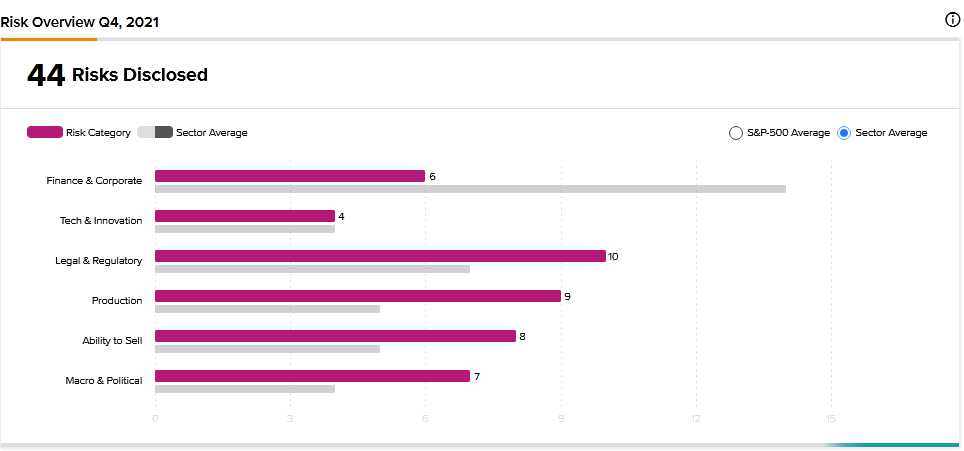

According to the new TipRanks Risk Factors tool, Wynn Resorts’ top risk category is Legal and Regulatory, with 10 of the total 44 risks identified for the stock. Production and Ability to Sell are the next two major risk categories with 9 and 8 risks, respectively.

In a newly added Legal and Regulatory risk factor, Wynn Resorts tells investors that it is subject to laws and regulations that could change or get interpreted differently in the future. For example, it says that the authorities in Macau, China have proposed certain changes to Macau’s gaming laws.

The proposals include increasing the minimum capital requirements for concession holders to $623 million and stopping revenue-sharing arrangements between concession holders and gaming promoters. Wynn Resorts cautions that it cannot predict how the proposed changes will affect its business, financial condition, and operating results. The company reported a 28% year-over-year drop in its Macau revenue to $131.7 million in Q4.

Moreover, Wynn Resorts says that its existing concession agreement with the Macau government expires on June 26, 2022. It warns that if it is unable to get the concession extended or renewed, the Macau government could take over its gaming operations without compensation, which would have a material adverse impact on its business and financial condition.

In an updated Finance and Corporate risk factor, Wynn Resorts informs investors that certain stockholders have significant influence over its decisions. It explains that an investor called Elaine P. Wynn owns 8% of its outstanding common stock. As a result, Wynn has the ability to exert influence over company matters that require shareholder approval, such as major corporate transactions.

Analysts’ Take

In February, following Wynn Resorts’ Q4 earnings report, Goldman Sachs analyst Stephen Grambling reiterated a Hold rating on Wynn Resorts stock and raised the price target to $104 from $91. Goldman’s new price target suggests 21.94% upside potential.

Consensus among analysts is a Moderate Buy based on 4 Buys and 8 Holds. The average Wynn Resorts price target of $110.75 implies 29.85% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Verizon Partners with Celona to Launch Turn-key Private Networking Solution

Costco Posts Upbeat Second Quarter Results; Street Says Buy

Making Sense of Workday’s Risk Factors